Advertisement

The State With the Lowest Downpayment Average Is …

While the average downpayment fell during the third quarter, some states have a lower average than others.

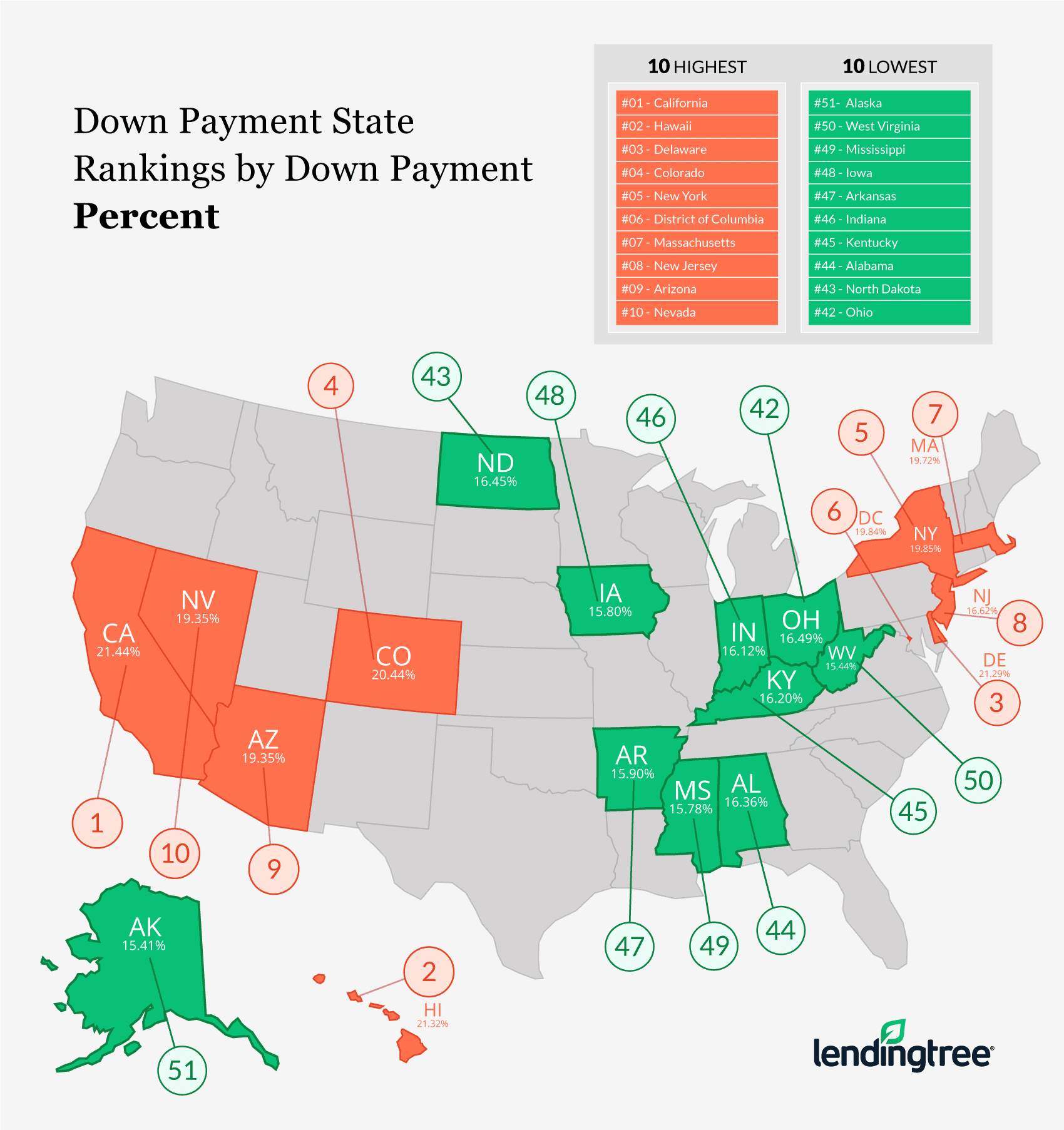

According to new data released by Lending Tree, Alaska had the lowest average down payment percentage rate at 15.41 percent, followed by West Virginia at 15.44 percent and Mississippi with 15.78 percent. The national average is 18.05 percent, and California had the highest rate at 21.44 percent.

In terms of the average sum offered as a downpayment, West Virginia recorded the third-quarter lowest rate at $21,415, followed by Arkansas at $21,707 and South Dakota at $22,149. The national average is $47,265, and California had the highest average at $97,809—far ahead of the second-highest average in Hawaii at $69,923.

“The average down payment for a home is decreasing and loan amounts fell,” said LendingTree Chief Economist Tendayi Kapfidze. “This is good news if you are looking to buy, as it means that you will need to save less money for a down payment. If high downpayments have deterred you from buying a home in the past, now might be a good time to reconsider your options.”

About the author