Advertisement

Mortgage Rates Slightly Lower

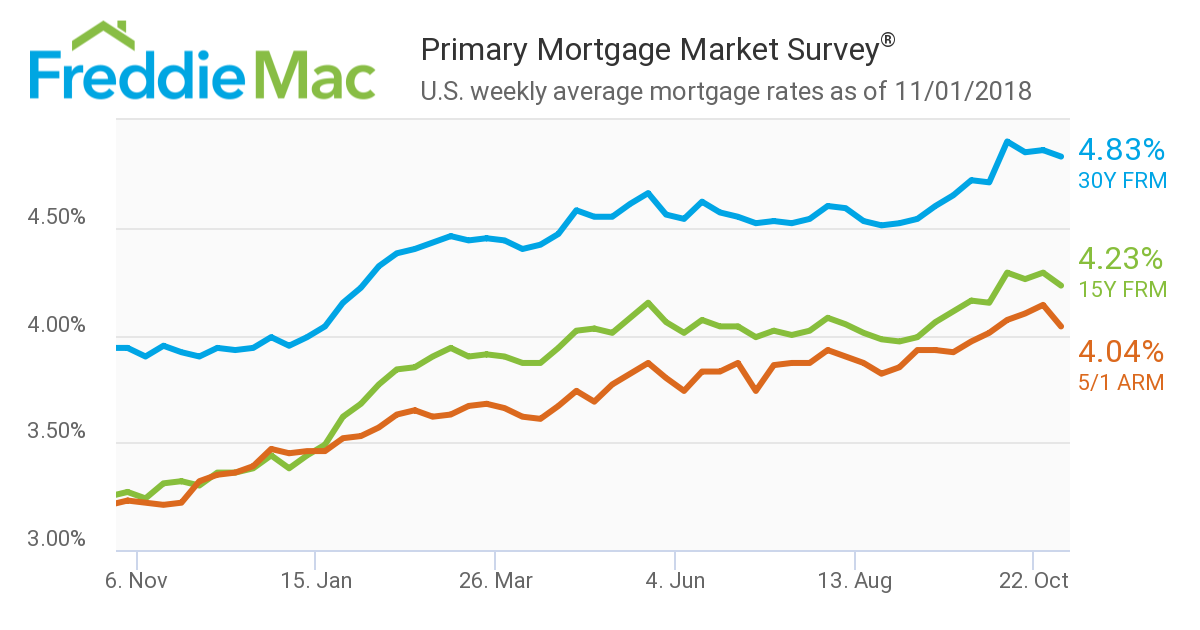

Mortgage rates took a slight dip in the latest Primary Mortgage Market Survey (PMMS) from Freddie Mac.

The 30-year fixed-rate mortgage (FRM) averaged 4.83 percent for the week ending Nov. 1, down from last week when it averaged 4.86 percent. The 15-year FRM this week averaged 4.23 percent, down from last week when it averaged 4.29 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 4.04 percent, down from last week when it averaged 4.14 percent.

Sam Khater, Freddie Mac’s Chief Economist, insisted that any increase in mortgage rates will not damage the housing market or the wider economy.

“While higher mortgage rates have led to a decline in home sales this year, the weakness has been concentrated in expensive segments versus entry-level and first-time buyer which remains firm throughout most of the rest of the country,” Khater said. “Despite higher mortgage rates, the monthly mortgage payment remains affordable. For many buyers the chronic lack of entry-level supply is a larger hurdle than higher mortgage rates because choices are limited and the inventory shortage has caused home prices to rise well above fundamentals.”

About the author