Advertisement

Mortgage Credit Availability, Home Prices Up

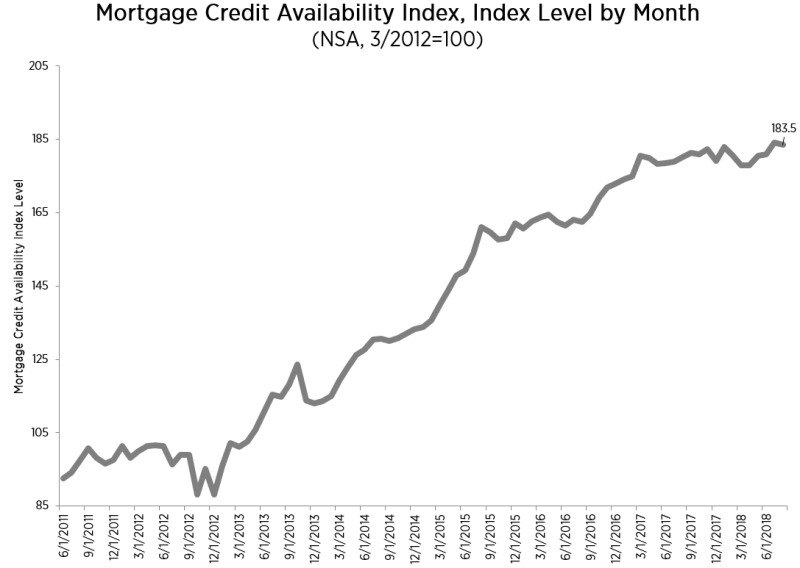

Home prices are still rising, and increased levels of mortgage credit availability are helping unite borrowers with properties, according to two new data reports.

The Mortgage Bankers Association (MBA) reported a 2.5 percent increase in its Mortgage Credit Availability Index (MCAI), ending the month at a 186.7 reading. Among the MCAI components, the Conventional MCAI was up by 5.5 percent, the Jumbo MCAI increased by 6.3 percent and Conforming MCAI rose by 4.6 percent. Only the Government MCAI dropped, with a 0.4 percent slide.

“Credit availability increased in October, driven largely by an expansion in the supply of conventional credit, while government credit fell slightly over the month,” said Joel Kan, MBA's Associate Vice President of Economic and Industry Forecasting. “Reversing a trend from last month, lenders made more conventional and low downpayment programs available to prospective borrowers. This increase in supply was likely in response to a growing number of first-time home buyers in the market, as home price appreciation has slowed and wage growth has picked up. Jumbo credit availability also expanded last month, with the jumbo index increasing again to its highest level since the survey began.”

Separately, CoreLogic reported September’s home prices were up by 5.6 percent from one year earlier and were up 0.4 percent from the previous month. CoreLogic is also forecasting a 4.7 percent on a year-over-year basis from September 2018 to September 2019 and a 0.6 percent drop between September to October 2018.

CoreLogic also reported that its Market Condition Indicators analysis determined that 38 percent of nation’s 100 largest metropolitan areas had overvalued housing markets during September, while 19 percent were undervalued and 43 percent were at value.

“The erosion of affordability in the highest cost markets has begun to slow home price growth,” said Frank Nothaft, Chief Economist for CoreLogic. “Hawaii, California and Massachusetts had median sales prices above $400,000 this summer, the highest in the nation, while annual home price growth slowed steadily between June and September in these three states. When comparing September 2018 with September 2017, annual price appreciation slowed more in these states than in the U.S overall. Nationally, annual price growth slowed 0.5 percentage points. However, in Hawaii, California and Massachusetts growth rates decreased by 1.7, 0.7 and 1.0 percentage points, respectively.”

About the author