Advertisement

Mortgage Delinquency Rate Remains at 12-Year Low

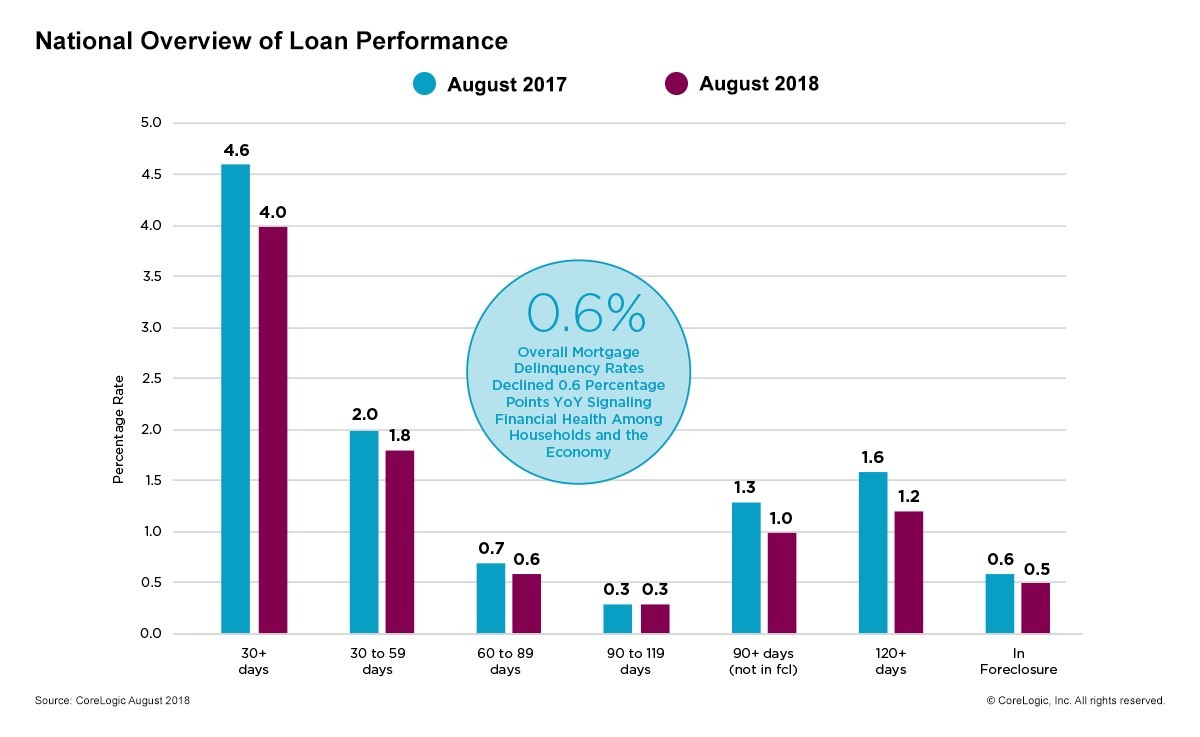

Four percent of mortgages were in some stage of delinquency during August, according to new data from CoreLogic. This represents a 0.6 percentage point decline from August 2017, when the rate was 4.6 percent.

The foreclosure inventory rate in August was 0.5 percent, down 0.1 percentage point from one year earlier. The August rate tied with the rate recording in April, May, June and July as the lowest for any month since September 2006, when it was also 0.5 percent.

The rate for early-stage delinquencies was 1.8 percent in August 2018, down from 2 percent one year earlier. The share of mortgages that were 60 to 89 days past due in August was 0.6 percent, compared to 0.7 percent in August 2017. And the serious delinquency rate was 1.5 percent in August, down from 1.9 percent in August 2017. This serious delinquency rate was the lowest for August since 2006 when it was 1.4 percent, and the lowest for any month since March 2007 when it was also 1.5 percent.

No state posted an annual gain in the overall delinquency rate, while Alaska was the only state to post an annual gain in the serious delinquency rate.

“Declines in delinquency rates are good news for America’s homeowners and mortgage lenders,” said Frank Martell, President and Chief Executive Officer of CoreLogic. “However, risks that create loan default like natural disasters, overvalued markets and an eventual rise in unemployment remain in the market. CoreLogic Market Conditions Indicator data has identified more than one-third of metropolitan areas are overvalued, putting them at risk of price declines and rising delinquencies if local job losses should occur.”

About the author