Advertisement

Zillow: Student Debt Limits Homebuying Options

Potential homeowners burdened with student loan debt can be limited in their buying by as much as $92,440, according to new data from Zillow.

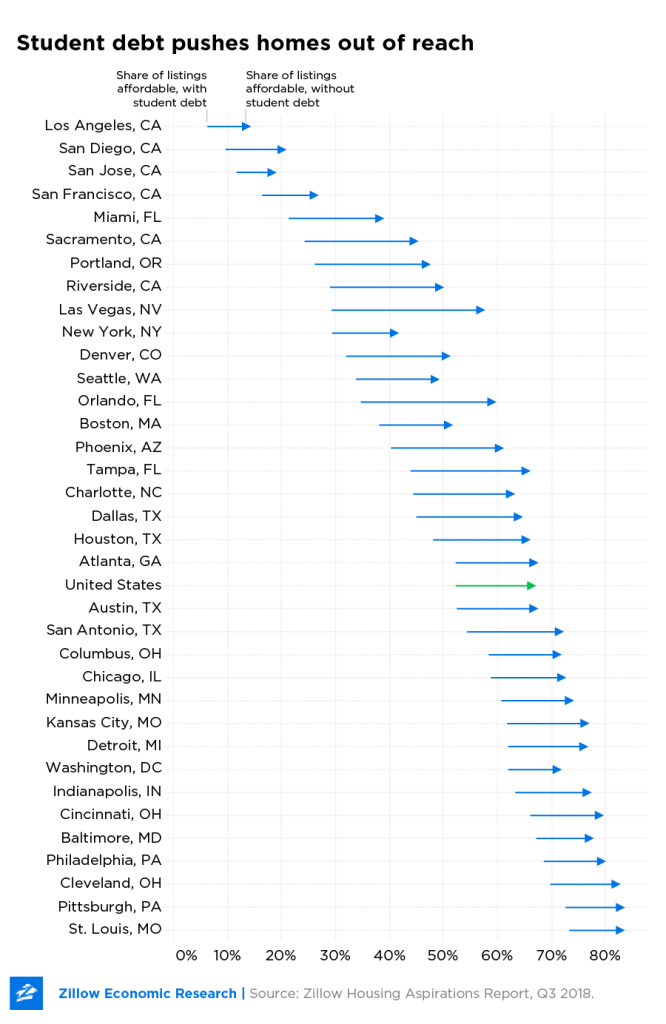

Student debt topped $1.56 trillion in the third quarter, a new record. Zillow’s data analysis determined the average monthly student debt payment for renters who plan to buy a home in the next year is $388, but the maximum priced home a buyer with student debt could afford is $269,400—provided that they spend no more than 30 percent of their income on combined housing and student debt. Working under this scenario, would-be buyers would only be able to buy 52.3 percent of homes currently listed for sale. On the flip side, a buyer with no student debt seeking to spend the same share of income enjoys a buying limit up to $361,800 and the ability to buy 66.4 percent of available homes nationwide.

“Higher education pays off when it comes to lifetime earnings and the long-term odds of homeownership, but carrying any kind of debt limits how much home buyers can afford,” said Zillow Senior Economist Aaron Terrazas. “For today's generation of young homebuyers, who came of age in a period of rapidly rising education costs, student debt payments can delay the pace of downpayment savings and put a dent in their max price point once they do decide to buy. With for-sale supply still tightest for the most affordable homes, but increasingly available at higher prices, even a small reduction in a buyer's target price point can result in substantially fewer options.”

About the author