Advertisement

New Report Reaffirms Evaporating Homeownership Affordability

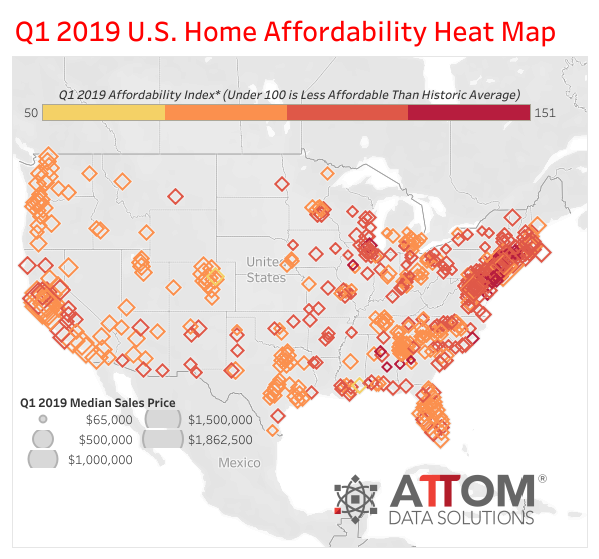

Median home prices during the first quarter were not affordable for average wage earners in nearly two-thirds of the country, according to a new report from ATTOM Data Solutions.

In the first three months of this year, 335 out of 473 counties analyzed by ATTOM Data Solutions, or 71 percent, had housing markets where a median-priced home could not be obtained by the average wage earner. A total of 308 of the 473 counties analyzed in the report, or 65 percent, posted a year-over-year decrease in their affordability index, meaning that home prices were less affordable than a year ago. Home price appreciation outpaced average weekly wage growth in 232 of the 473 counties analyzed in the report, or 49 percent.

Nationwide, an average wage earner would need to spend 32.7 percent of his or her income to buy a median-priced home in the first quarter, on par with the historic average of 32.7 percent of income. Counties where an average wage earner would need to spend the highest share of income to buy a median-priced home in the first quarter were Kings County (Brooklyn), N.Y. (115.9 percent), New York County (Manhattan), N.Y. (115.0 percent), Santa Cruz County, Calif. (114.1 percent), Marin County in the San Francisco metro area (103.1 percent) and Maui County, Hawaii (100.7 percent). Counties where an average wage earner would need to spend the lowest share of income to buy a median-priced home were Bibb County (Macon), Ga. (11.1 percent), Baltimore City, Md. (12.4 percent), Wayne County (Detroit), Mich. (13.2 percent), Rock Island County (Quad Cities), Ill. (13.5 percent) and Montgomery County, Ala. (13.9 percent).

“We are seeing a housing market in flux across the United States, with a mix of tailwinds and headwinds that are pricing many people out of the housing market, but also are creating potentially better conditions for buyers,” said Todd Teta, Chief Product Officer with ATTOM Data Solutions. “Continually rising home prices in many areas do remain a financial stretch–or simply unaffordable–for a majority of households. However, quarterly wage gains have been outpacing prices increases for more than a year and mortgage rates are falling, which have helped make homes a bit more affordable now, than they’ve been in a year. Affordability may improve because of the simple fact that homes are out of reach for so many home seekers, suggesting that prices need to moderate up in order to attract buyers.”

About the author