Advertisement

Declines in Foreclosure Activity, Home Credit Delinquencies

Two new data reports have determined downward motion in foreclosure activity and consumer credit delinquencies related to homeownership.

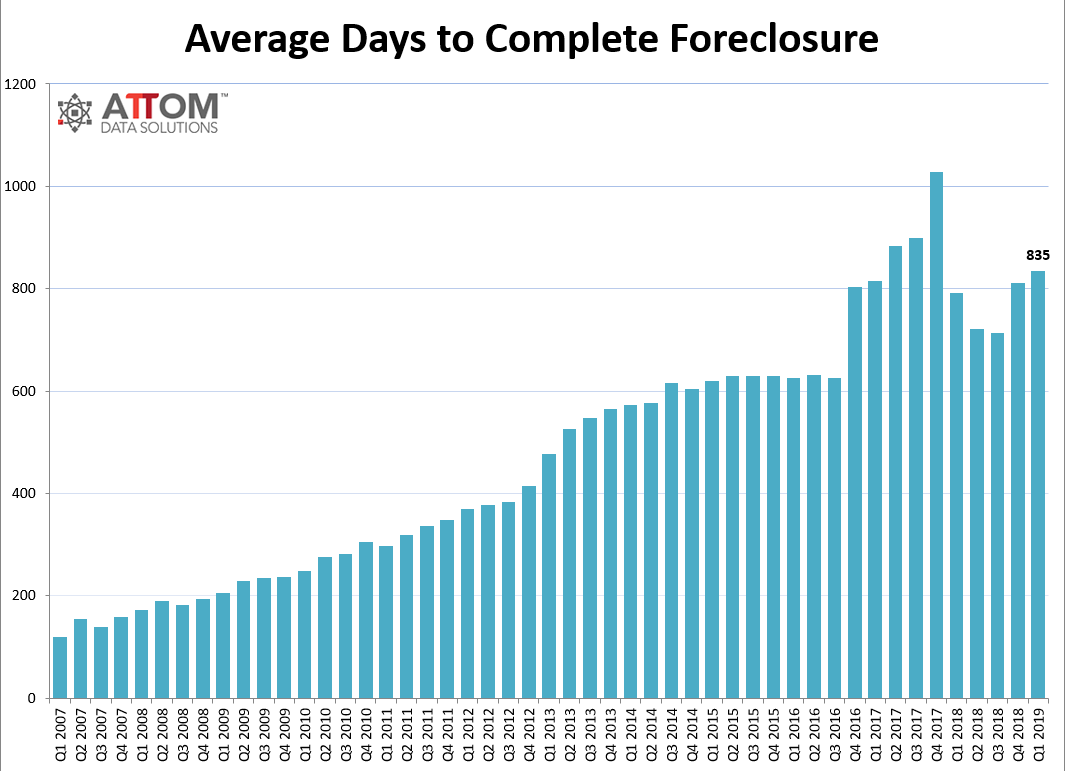

A total of 161,875 properties had a foreclosure filing during the first quarter, according to new statistics released by ATTOM Data Solutions. This represents a 23 percent decline from the previous quarter, a 15 percent drop from one year earlier and the lowest level since the first quarter of 2008. Lenders started the foreclosure process on 91,397 properties in the first quarter, up seven percent from the previous quarter but down three percent from a year ago. This marked the 15th consecutive quarter with a year-over-year decrease in foreclosure starts.

During March, there were 58,550 properties with foreclosure filings, up seven percent from February but down 21 percent from the previous year. March was the ninth consecutive month with a year-over-year decrease in foreclosure activity. Nationwide, one in every 2,312 properties had a foreclosure filing in March.

“While some markets saw a slight uptick in foreclosure filings, that is above pre-recession levels, the majority of the major markets are well below pre-recession levels,” said Todd Teta, Chief Product Officer at ATTOM Data Solutions. “While we did see a slight increase in U.S. foreclosure starts from last quarter, bank repossessions reached an all-time low in the first quarter of 2019, showing continuing signs of a strong housing market.”

Separately, the American Bankers Association (ABA) reported declines in four home-related consumer credit categories during the fourth quarter of 2018: Home equity loan delinquencies dipped from 2.53 percent to 2.52 percent, mobile home delinquencies dropped from 4.39 percent to 3.84 percent, property improvement loan delinquencies inched down from 1.14 percent to 1.12 percent and home equity lines of credit delinquencies fell from 1.14 percent to 1.09 percent.

“Banks remain vigilant in their underwriting approach,” said James Chessen, ABA’s Chief Economist. “The Fed has put further rate increases on hold unless there are clear signs of inflation, and that in part recognizes the tightening of credit across some key markets. Consumers remain on strong financial footing, and continuing their strong track record of spending within their means is the best approach to meeting all of their obligations.”

“Banks remain vigilant in their underwriting approach,” said James Chessen, ABA’s Chief Economist. “The Fed has put further rate increases on hold unless there are clear signs of inflation, and that in part recognizes the tightening of credit across some key markets. Consumers remain on strong financial footing, and continuing their strong track record of spending within their means is the best approach to meeting all of their obligations.”

About the author