Advertisement

Seriously Underwater Property Levels Up 25 Percent YOY

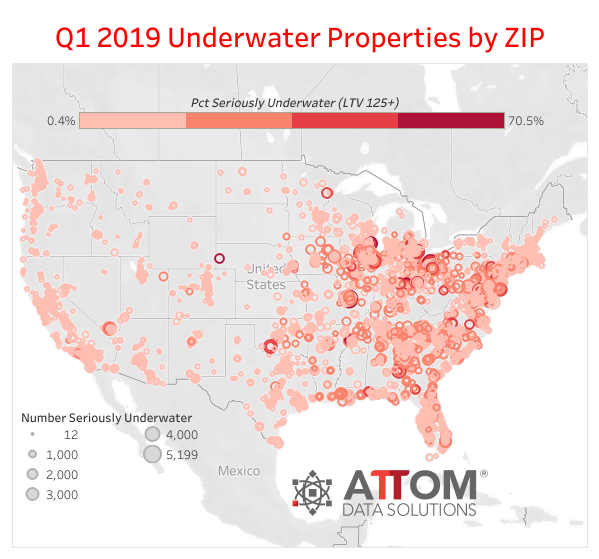

More than 5.2 million residential were seriously underwater during the first quarter, up by 17,000 properties or 25 percent from one year ago, according to new statistics from ATTOM Data Solutions. The first quarter level 9.1 percent of all properties with a mortgage, up from 8.8 percent in the previous quarter but down from 9.5 percent in the first quarter of 2018.

The states with the highest share of seriously underwater properties were Louisiana (20.7 percent), Mississippi (17.1 percent), Arkansas (16.3 percent), West Virginia (16.2 percent) and Illinois (16.2 percent). Among the major metro areas, the highest share of seriously underwater properties was found in Baton Rouge, La. (21.3 percent), Scranton, Pa. (20 percent), Youngstown, Ohio (19.2 percent), Toledo, Ohio (19.2 percent) and New Orleans (17.8 percent).

“With home prices increasing at a slower pace in 2018, than in previous years, the potential for people to climb out from mortgages that are underwater or advance into equity-rich territory, tends to be reduced,” said Todd Teta, chief product officer at ATTOM Data Solutions. However, only one in 11 mortgages are seriously underwater today, compared to nearly one in three during the depths of the recession. Although, if the latest trend continues, it will raise another clear signal of a market slowdown, which will be good for buyers, but not so good for sellers. But if the pattern of the past few years takes hold–with levels of underwater and equity rich mortgages turning around - it will mean the market remains strong for sellers, with fewer needing to get out from under financial distress.”

About the author