Advertisement

Bidding Wars at Peaceful Low

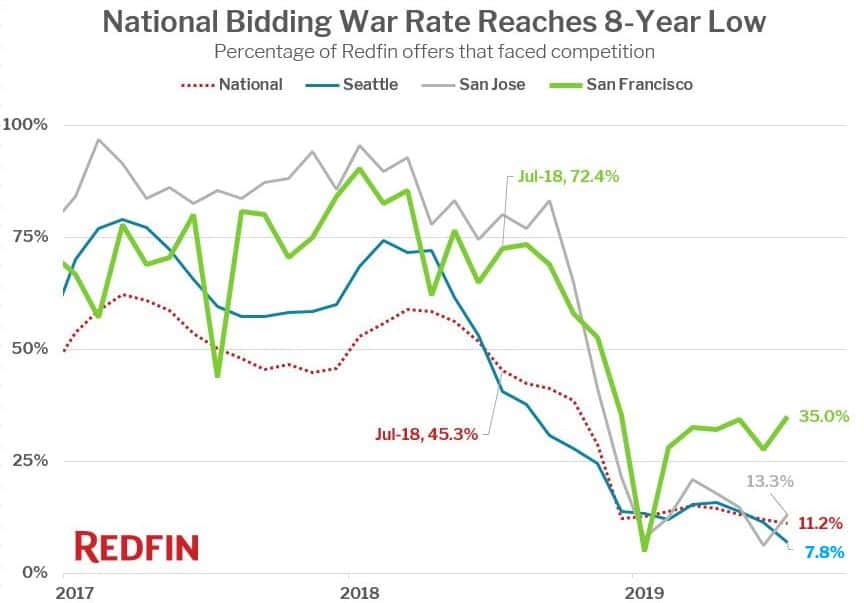

It appears to be all quiet on the bidding war front, as new data from Redfin finds a dramatic decline in prospective homebuyers one-upping each other.

During July, Redfin found only 11 percent of offers nationwide faced a bidding war, from more than 45 percent one year ago. July’s level was the lowest rate of bidding wars since 2011. The bidding war level peaked at 59 percent in March 2018.

San Francisco was the most competitive market in July, with 35 percent of Redfin offers facing a bidding war–one year ago, that level was at 72.4 percent. Miami was the least competitive market in July, with just 1.3 percent of the offers submitted by Redfin agents facing competition.

"Mortgage rates have been mostly flat for the last month, and so has homebuyer competition, which was beginning a fast descent this time last year as mortgage rates were inching toward five percent," said Redfin Chief Economist Daryl Fairweather. "On a local level, it's noteworthy that some of 2018's fiercely competitive markets—San Jose, Seattle, Los Angeles—have seen their bidding war rates plummet the most year over year. Home prices in these expensive markets have also been falling annually. Overall, I expect homebuyer demand to strengthen in the second half of the year as the housing market continues to stabilize, but we may not see a big pop in bidding wars until early next year."

About the author