Advertisement

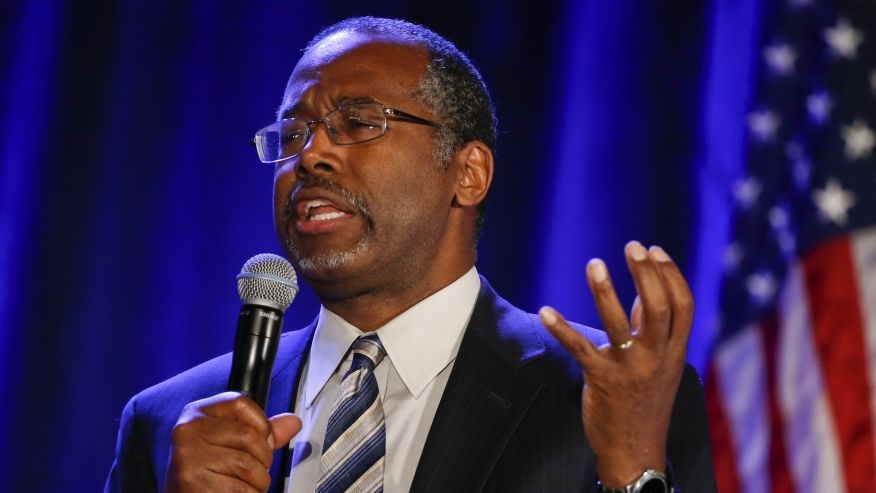

HUD Inspector General Clears Carson on Furniture Controversy

The U.S. Department of Housing & Development’s (HUD) Office of the Inspector General has determined there was no misconduct by Secretary Ben Carson in connection to the attempted purchase of a $31,561 dining set for his office.

Fox News obtained a still-unreleased 14-page copy of the report, which centered on a mid-2017 effort to replace 30-year-old dining room furniture at Carson’s HUD office suite that was determined to be in poor condition. News of the furniture purchase was publicized by Helen Foster, a former Chief Administrative Officer at HUD, who claimed that she lost her job because she refused an alleged demand by Candy Carson, the HUD Secretary’s wife, to find a way to exceed the $5,000 limit on furnishings for Carson’s office. Carson cancelled the furniture order in March 2018 and promised a “full disclosure” over the matter.

The Inspector General report stated that that Carson left furniture purchasing decision to members of his staff, “in consultation with his wife, who provided stylistic input after the Department decided to purchase new furniture.” The report blamed Department officials for their lack of oversight in the procurement process, noting the HUD staff should have been aware that purchases above the $5,000 limit required a notification to Congress.

“We found no evidence indicating that either Secretary or Mrs. Carson exerted improper influence on any departmental employee in connection with the procurement,” the report said “We did not find sufficient evidence to substantiate allegations of misconduct on the part of Secretary Carson in connection with this procurement.”

About the author