Advertisement

Existing-Home Sales Rise Again in August

According to the National Association of Realtors (NAR), existing-home sales rose in August, marking two consecutive months of growth.

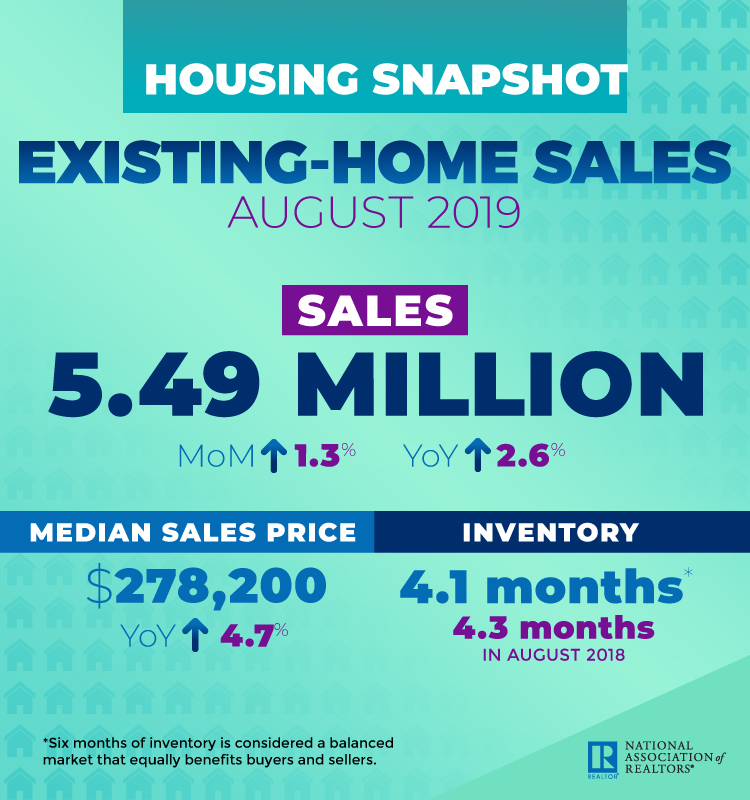

Three of the four major regions reported a rise in sales, while the West recorded a decline last month. Total existing-home sales, categorized as completed transactions that include single-family homes, townhomes, condominiums and co-ops, rose 1.3 percent from July to a seasonally adjusted annual rate of 5.49 million in August. Overall sales are up 2.6 percent from a year ago (5.35 million in August 2018).

“As expected, buyers are finding it hard to resist the current rates,” said Lawrence Yun, NAR’s chief economist. “The desire to take advantage of these promising conditions is leading more buyers to the market.”

The median existing-home price for all housing types in August was $278,200, up 4.7 percent from August 2018 ($265,600). August’s price increase marks the 90th straight month of year-over-year gains.

“Sales are up, but inventory numbers remain low and are thereby pushing up home prices,” said Yun. “Home builders need to ramp up new housing, as the failure to increase construction will put home prices in danger of increasing at a faster pace than income.”

Total housing inventory at the end of August decreased to 1.86 million, down from 1.90 million existing-homes available for sale in July, and marking a 2.6 percent decrease from 1.91 million one year ago. Unsold inventory is at a 4.1-month supply at the current sales pace, down from 4.2 months in July and from the 4.3-month figure recorded in August 2018.

Properties typically remained on the market for 31 days in August, up from 29 days in July and in August of 2018. Forty-nine percent of homes sold in August were on the market for less than a month.

“The Federal Reserve should have been bolder and made a deeper rate cut, given current low inflation rates,” said Yun. “The housing sector has been broadly underperforming, but there is huge upward potential there that will help our overall economy grow.”

First-time buyers were responsible for 31 percent of sales in August, down from 32 percent in July and equal to the 31 percent recorded in August 2018. NAR’s 2018 Profile of Home Buyers and Sellers–released in late 2018–revealed that the annual share of first-time buyers was 33 percent.

As the share of first-time buyers rose, individual investors or second-homebuyers, who account for many cash sales, purchased 14 percent of homes in August 2019, up from 11 percent recorded in July and from 13 percent recorded in August a year ago. All-cash sales accounted for 19 percent of transactions in August, about equal to July’s percentage and moderately down from August 2018 (19 percent and 20 percent, respectively).

Distressed sales–foreclosures and short sales–represented two percent of sales in August, unchanged from July, but down from three percent in August 2018.

“Rates continue to be historically low, which is extremely beneficial for everyone buying or selling a home,” said NAR President John Smaby, a second-generation Realtor from Edina, Minn., and broker at Edina Realty. “The new condominium loan policies, as well as other reforms NAR is pursuing within our housing finance system, will allow even more families and individuals in this country to reach the American Dream of homeownership.”

Tian Liu, chief economist at Genworth Mortgage Insurance, said: “Existing-home sales remained strong in August as lower interest rates and slower growth in home prices continued to support the housing market despite rising uncertainty in the economy. How consumers react to rising economic uncertainty is a key question facing the U.S. economy, and as the largest purchase for most families, home sales are uniquely positioned to address this question. Today’s data shows that at least for now, consumers remain confident enough to buy a home in the current market.”

About the author