Advertisement

Foreclosure Inventory Rate Remains at 20-Year Low

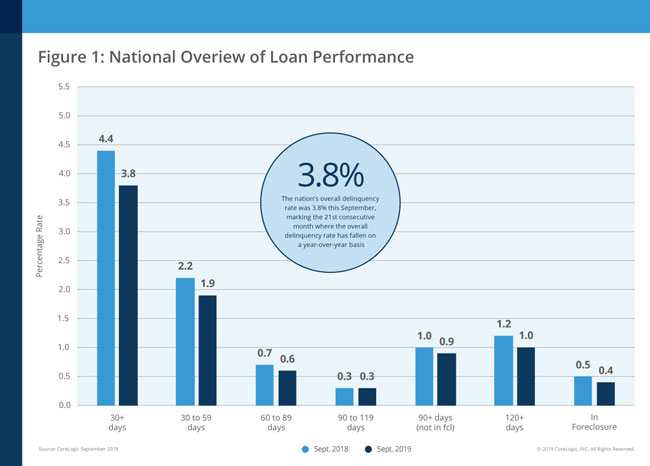

New data released by CoreLogic has determined 3.8 percent of mortgages were in some stage of delinquency during September, down 0.6 percent from one year earlier. September’s foreclosure inventory rate was 0.4 percent, down 0.1 percentage point from September 2018.

The September foreclosure inventory rate tied the prior 10 months as the lowest for any month since at least January 1999, CoreLogic added.

The rate for early-stage delinquencies in September was 1.9 percent, down from 2.2 percent in September 2018. The share of mortgages 60 to 89 days past due was 0.6 percent, down from 0.7 percent one year earlier, while the 1.3 percent serious delinquency rate fell from 1.5 percent in September 2018. The serious delinquency rate has remained consistent since April, CoreLogic noted.

Also, the share of mortgages that transitioned from current to 30 days past due was 0.8 percent in September, down by 0.4 percentage points from the previous year. No states posted a year-over-year increase in the overall delinquency rate in September 2019. The states that logged the largest annual decreases included: Mississippi (-1.1 percentage points), North Carolina (-1.1 percentage points), Louisiana (-1.0 percentage points), New Jersey (-1.0 percentage points) and South Carolina (-1.0 percentage points).

“The decline in delinquency rates in North and South Carolina compared with a year ago reflect the recovery from Hurricanes Florence and Michael, which hit in the autumn of 2018,” said Frank Nothaft, chief economist at CoreLogic. “Shortly after a natural disaster, we tend to see a spike in delinquency rates. Depending on the extent of devastation, serious delinquency rates generally return to their pre-disaster levels within a year.”

About the author