Research from ATTOM Data Solutions shows that there were a total of 156,253 U.S. properties with foreclosure filing during the first quarter of 2020, a 42 percent increase from the previous quarter, but still down three percent from a year ago.

For March, the report showed a total of 46,800 properties with foreclosure filings, down three percent from February 2020 and down 20 percent from March 2019. The report does state that these numbers could rise given the current state of unemployment in the U.S. as a result of the COVID-19 pandemic.

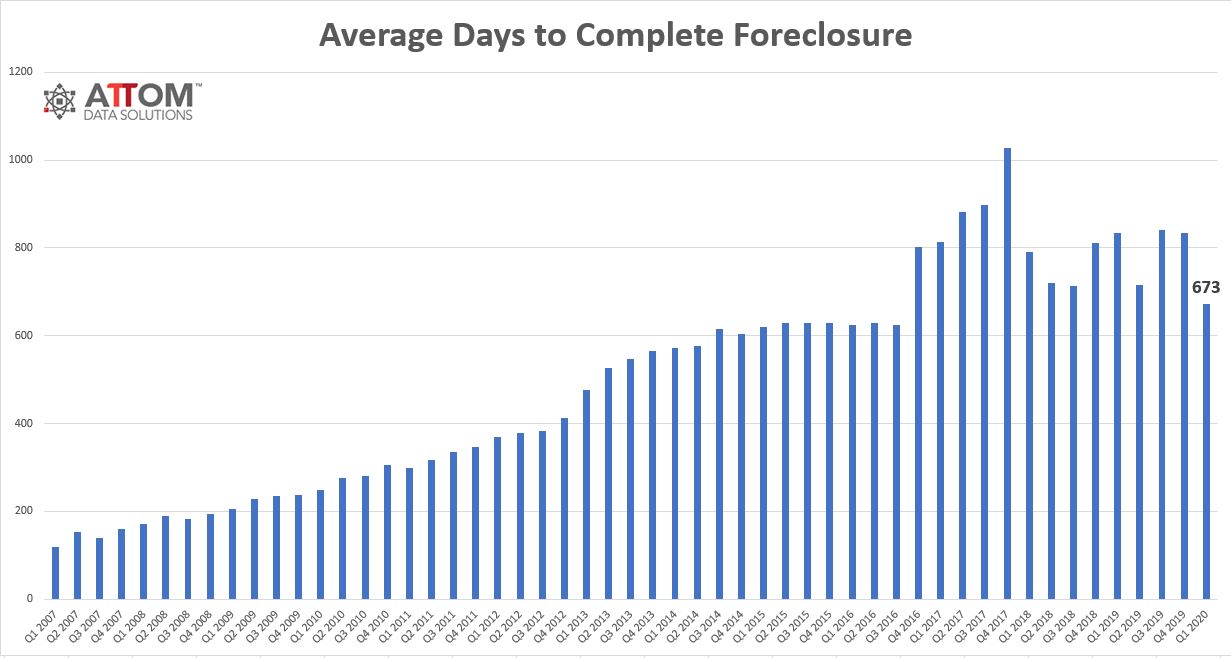

"As foreclosure activity across the country continued to decline in March, contributing to a run of quarterly declines, the number of filings remains just one-sixth of what it was following the Great Recession a decade ago," said Todd Teta, chief product officer at ATTOM Data Solutions. "This latest sign of the strong national housing market, however, comes with a huge caveat because it captures the pivotal month when millions of Americans started losing their jobs because of the economic fallout connected to the Coronavirus pandemic. Banks are temporarily holding off on foreclosures and we expect this will bring foreclosures even lower for at least the next few quarters. However, with unemployment and other distress factors hitting the economy now, the numbers could rise significantly later this year and into next, depending on how many people can't keep up with their payments."