Advertisement

NAR Chief Economist: Housing Slump 'Temporary' as Pending Sales Dip

Pending home sales fell in March saw expected declines as a result of the coronavirus outbreak, according to the National Association of Realtors. Each of the four major U.S. regions saw drops in month-over-month contract activity and year-over-year pending home sales transactions.

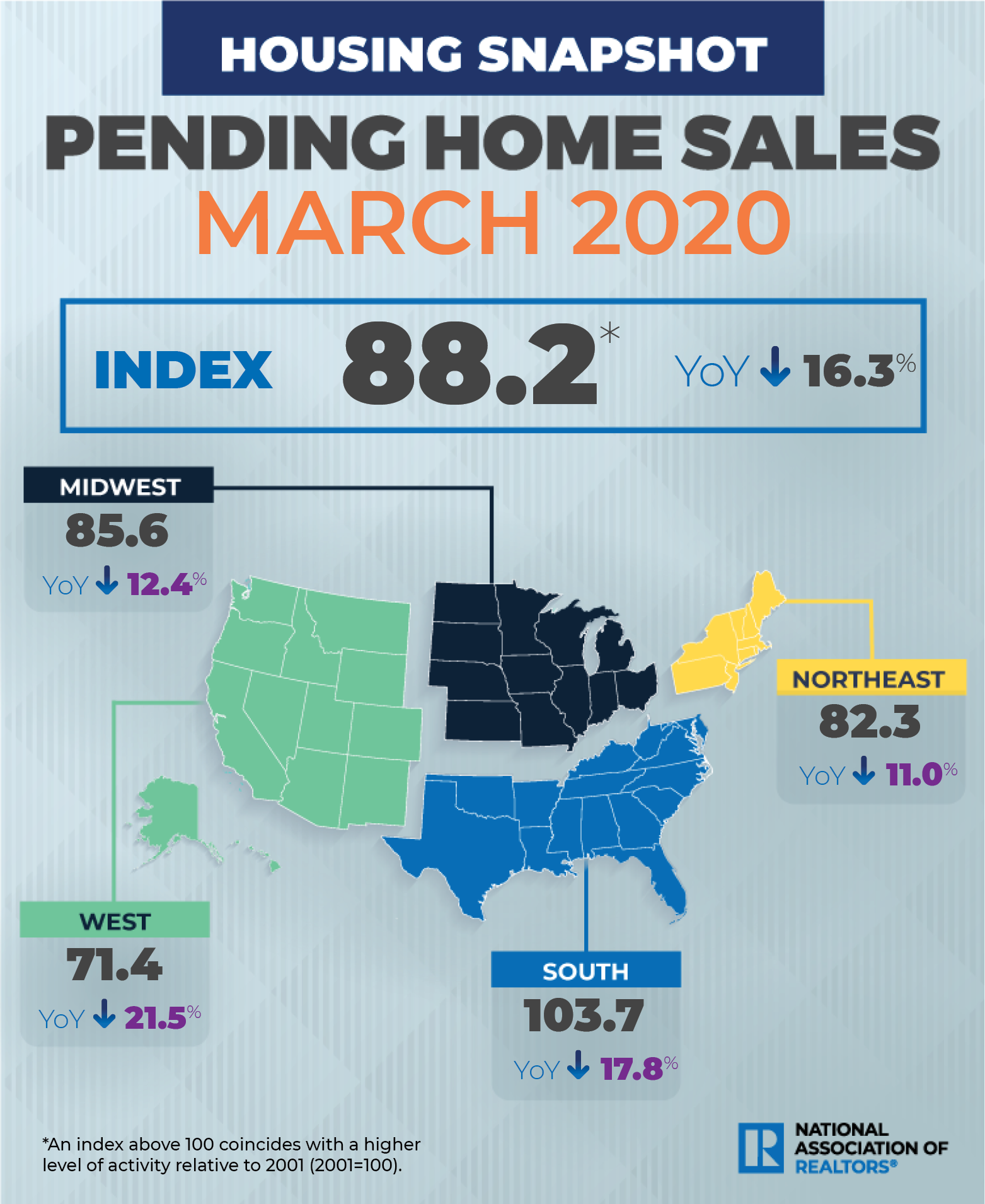

The Pending Home Sales Index, a forward-looking indicator based on contract signings, decreased 20.8% to 88.2 in March. Year-over-year, contract signings declined 16.3%. An index of 100 is equal to the level of contract activity in 2001.

“The housing market is temporarily grappling with the coronavirus-induced shutdown, which pulled down new listing and new contracts,” said Lawrence Yun, the Realtor association's chief economist. “As consumers become more accustomed to social distancing protocols, and with the economy slowly and safely reopening, listings and buying activity will resume, especially given the record low mortgage rates.”

Citing results from the National Association of Realtors’ April 19-20 Flash Survey, Yun says technology tools such as virtual tours and e-signings are helping connect buyers and sellers. Fifty-eight percent of Realtors reported that buyers are using virtual tours and 43% said buyers have taken advantage of e-closings.

“Although the pandemic continues to be a major disruption in regards to the timing of home sales, home prices have been holding up well,” Yun said. “In fact, due to the ongoing housing shortage, home prices are likely to squeeze out a gain in 2020 to a new record high. I project the national median home price to increase 1.3% for the year, though there will be local market variations and the upper-end market will likely experience a reduction in home price.”

Regionally, the Northeast pending home sales index dropped 14.5% to 82.3 in March, 11% lower than a year ago. In the Midwest, the index decreased 22% to 85.6 last month, down 12.4% from March 2019. In the South, sales sank 19.5% to 103.7, a 17.8% drop from March 2019, and the index in the West fell 26.8% in March 2020 to 71.4, down 21.5% from a year ago.

Also on Wednesday, the Department of Commerce reported that gross domestic product decreased at an annual rate of 4.8% in the first quarter of 2020. In the fourth quarter of 2019, real GDP increased 2.1%. The decline in first quarter GDP was directly attributed to the spread of COVID-19, as governments issued “stay-at-home” orders in March, resulting in changes to demand, as businesses and schools switched to a remote atmosphere or canceled operations altogether, and consumers canceled, restricted or redirected their spending.

And despite a down economy, Mortgage Bankers Association Chief Economist Mike Fratantoni sees housing as a bright spot in lifting a sagging economy. “The decline in GDP in the first quarter really reflects the sudden stop of economic activity in March. We expect an even steeper decline in the second quarter, as the country has been in lockdown in April,” said Fratantoni. “However, as indicated in our purchase application data out this morning, we are beginning to see an uptick in the pace of housing demand, which coincides with re-openings in parts of the country.”

About the author