Advertisement

Zillow Forecasts Housing To Have A “Check Mark” Recovery

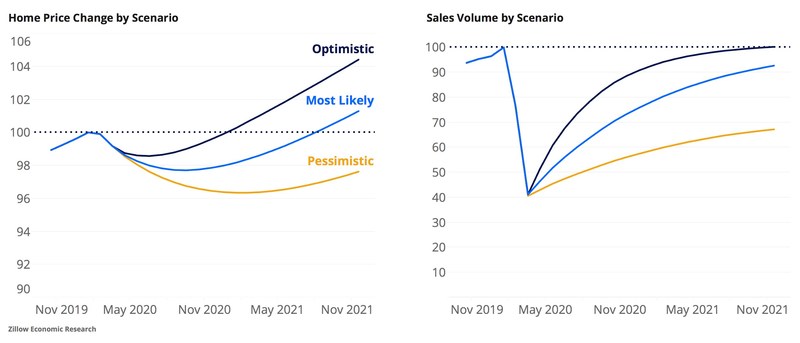

According to a new report from Zillow, buyer demand and healthy housing-market dynamics will prevent U.S. home prices from dropping more than 2.0%-3.0%—or more than 1.7% year over year—in the wake of the coronavirus. Zillow’s findings state that home sales will fall as much as 60% this spring and it will take through the end of 2021 to recover, while prices will fall through the year, but recover a few months sooner.

The recovery is likely to look like a check mark, with transactions building at a pace of about 10% each month through the end of 2021, according to the forecast by Zillow Chief Economist Svenja Gudell and her team of economists and analysts.

The steep drop in sales is spurred by overall economic uncertainty and the industry adjusting to public health orders that shut down or hindered the ways transactions have traditionally been done, combined with record-high unemployment claims, which found that approximately one-fifth of the nation’s workforce was currently unemployed.

Zillow’s forecast, based on published and proprietary macroeconomic and housing data, centers around a baseline prediction of a 4.9% decrease in United States GDP in 2020 and a subsequent 5.7% increase in 2021. Under that scenario, which Zillow believes is 70% probable, the market is expected to include:

►A 2.0%-3.0% drop in prices through the end of 2020, followed by a steady recovery throughout 2021.

►A rapid 50%-60% decline in home sales, bottoming out this spring and recovering at a pace of about 10% each month through 2021.

The forecast also includes a more pessimistic scenario (25% likelihood), which shows a 3.0-4.0% price drop with continued weakness through all of 2021. A more optimistic scenario (5.0% likelihood) features a 1.0-2.0% dip in home prices through the middle of this year, followed by a robust recovery. These projections vary based on the expected duration of the pandemic and the depth of its impact on the broader economy.

►A 2.0%-3.0% drop in prices through the end of 2020, followed by a steady recovery throughout 2021.

►A rapid 50%-60% decline in home sales, bottoming out this spring and recovering at a pace of about 10% each month through 2021.

The forecast also includes a more pessimistic scenario (25% likelihood), which shows a 3.0-4.0% price drop with continued weakness through all of 2021. A more optimistic scenario (5.0% likelihood) features a 1.0-2.0% dip in home prices through the middle of this year, followed by a robust recovery. These projections vary based on the expected duration of the pandemic and the depth of its impact on the broader economy.

"Much uncertainty still exists, particularly with some states beginning to reopen and experts warning of a possible second wave of the coronavirus in the fall. However, housing fundamentals are strong—much more so than they were leading into the Great Recession—and that bodes well for housing in general," said Gudell, Zillow's chief economist. "Despite the difficulties, we're seeing several signs that there is still a good amount of demand for housing, and buyers, sellers and agents are growing more comfortable moving transactions forward where possible. For those who need to sell, buyers are out there, and there are ways to embrace technology and practice social distancing to ensure a safe process."

About the author