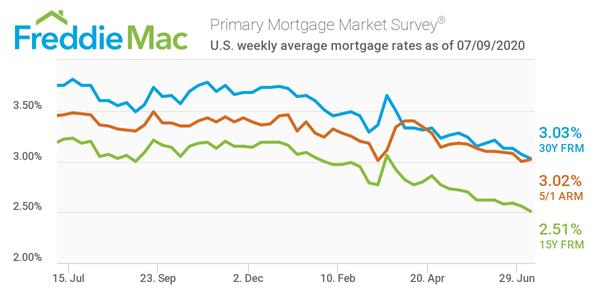

Mortgage Rates Move Even Closer To The 3% Mark

Week after week mortgage rates have been hitting record lows and this week continues the trend. Freddie Mac's latest Primary Mortgage Market Survey reported the 30-year fixed-rate mortgage hit an average 3.03%, another all-time low in the survey's history. A year ago, the 30-year fixed-rate mortgage averaged 3.75%.

“The summer is heating up as record-low mortgage rates continue to spur homebuyer demand,” said Sam Khater, Freddie Mac’s chief economist. “However, it remains to be seen whether the demand will continue if COVID cases rise to the point that it hinders economic growth.”

The 15-year fixed-rate mortgage averaged 2.51%, down from 2.56% last week and down considerably from a year ago where it averaged 3.22%. The 5-year Treasury-indexed hybrid adjustable-rate mortgage came in at an average of 3.03%, a slight increase from the previous week but still considerably lower than the 3.46% average a year ago.

Click here to see the full Freddie Mac PMMS.