AG Reminds California Mortgage Servicers Of COVID-19 Obligations

California Attorney General Xavier Becerra issued a letter to 33 mortgage servicers, reminding them of their obligations to homeowners and tenants under the state's Homeowner Bill of Rights. The letter comes as homeowners throughout the state brace for a wave of COVID-19 related foreclosures and post-foreclosure evictions.

"As the dual economic and public health crises continue, many California homeowners may fall behind on their mortgage payments," Becerra wrote in his letter. "During times like these, we must rely on laws, such as the California Homeowner Bill of Rights, to provide a safeguard for families who are one payment away from losing their homes. We take the rights of homeowners very seriously and expect all mortgage servicers to comply with the law."

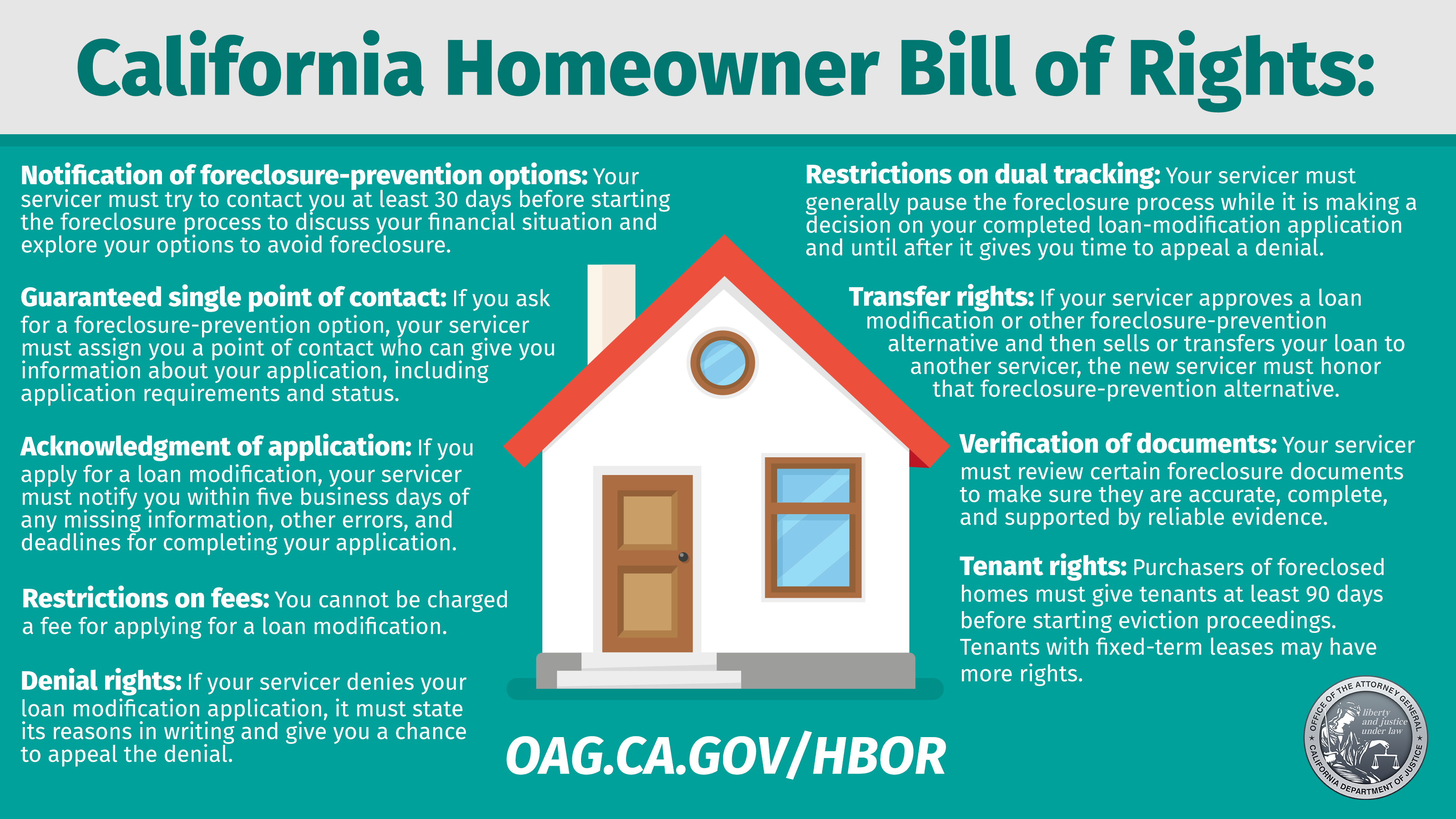

Under the law, homeowners have a right to fairness and transparency during the pre-foreclosure and foreclosure process, according to a statement accompanying the letter. They also have a right to be given a "meaningful opportunity to avoid losing their home."

Becerra was part of a coalition of 35 attorneys general that sent letters to U.S. Department of Housing and Urban Development Secretary Ben Carson and Federal Housing Finance Agency director Mark Calabria requesting more protection for homeowners who felt the economic impact from the COVID-19 pandemic.

Read Becerra's letter to mortgage servicers.