Mortgage Rates Remain Stagnant, Maintains Record Low

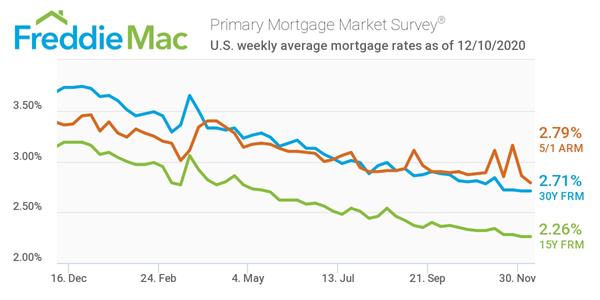

After hitting another record-low last week, Freddie Mac's Primary Mortgage Market Survey reported that rates have remained stagnant for the week ending Dec. 10.

"Mortgage rates remain at record lows, resisting their typical correlation to Treasury yields, which have recently been moving higher," said Sam Khater, Freddie Mac’s chief economist. "Mortgage spreads – the difference between mortgage rates and the 10-year Treasury rate – are declining from their elevated levels earlier this year. Although today’s mortgage spread is about 1.8 percent and still has some room to move down if the 10-year Treasury continues to rise, it’s encouraging to see that the spread is almost back to normal levels."

The only change to report in this week's PMMS is the 5-year Treasury-indexed hybrid adjustable-rate mortgage, which averaged 2.79%, down from last week's average of 2.86%.