Mortgage Rates Retreat For The Second Week In A Row

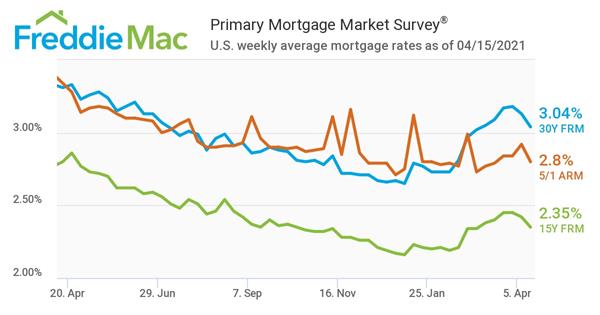

Freddie Mac's Primary Mortgage Market Survey reported that the 30-year fixed-rate mortgage averaged 3.04% for the week ending April 15, 2021, down from 3.13% the previous week. This marks the second consecutive week that rates have dipped, following weeks of increases. A year ago, the 30-year averaged 3.31%.

“Mortgage rates took another dip this week as the 30-year fixed-rate mortgage decreased by almost ten basis points, week-over-week,” said Sam Khater, Freddie Mac’s chief economist. “The economy is improving on the demand side and on the supply side, a variety of goods and materials remain scarce. As a result of this imbalance, pricing pressures are building and causing inflation to rise. Despite the pause in mortgage rates recently, we expect them to increase modestly for the remainder of this year.”

Additionally, the report showed that the 15-year fixed-rate mortgage averaged 2.35%, down from last week's average of 2.42%. Meanwhile, the 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.80%, down from last week's average of 2.92%.

Click here to view the full report.