Mortgage Rates Drop Below 3 Percent, Encouraging For Refis

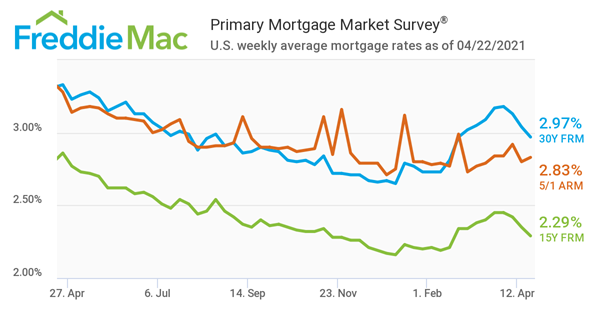

Mortgage rates retreated once again, this time falling back below 3%, according to Freddie Mac's Primary Mortgage Market Survey. According to the survey, the 30-year fixed-rate averaged 2.97%, down from last week's average of 3.04%.

"The drop in mortgage rates is good news for homeowners who are still looking to take advantage of the very low rate environment," said Sam Khater, Freddie Mac’s chief economist. "Freddie Mac research suggests that lower income and minority homeowners have been less likely to engage in the refinance market. Low and declining mortgage rates provide these homeowners the opportunity to reduce their monthly payment and improve their financial position."

Additionally, the survey reported that the 15-year fixed-rate mortgage decreased to 2.29%, down from 2.35% the previous week and 2.86% at the same time in 2020. The 5-year Treasury-indexed hybrid adjustable-rate mortgage increased slight from 2.80% to 2.83%.

Click here to view Freddie Mac's PMMS.