Advertisement

Image

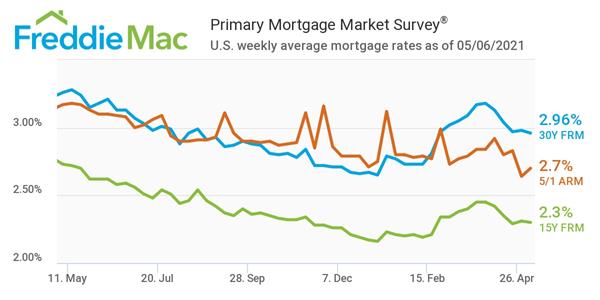

“Consumer income and spending are picking up, which is leading to an acceleration in economic growth. The combination of low and stable rates, coupled with an improving economy, is good for homebuyers. It’s also good for homeowners who may have missed prior opportunities to refinance and increase their monthly cash flow,” said Sam Khater, Freddie Mac’s chief economist.

The 15-year fixed-rate mortgage averaged 2.30%, down slightly from 2.31% the previous week. A year ago, the 15-year averaged 2.73%. Meanwhile, the 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 2.70%, up from last week's average of 2.64%.

Click here to read more from Freddie Mac's PMMS.