American Bankers Association Projects Weakening Credit Conditions

Lenders will be more cautious, ABA economists say in Q3 Credit Report.

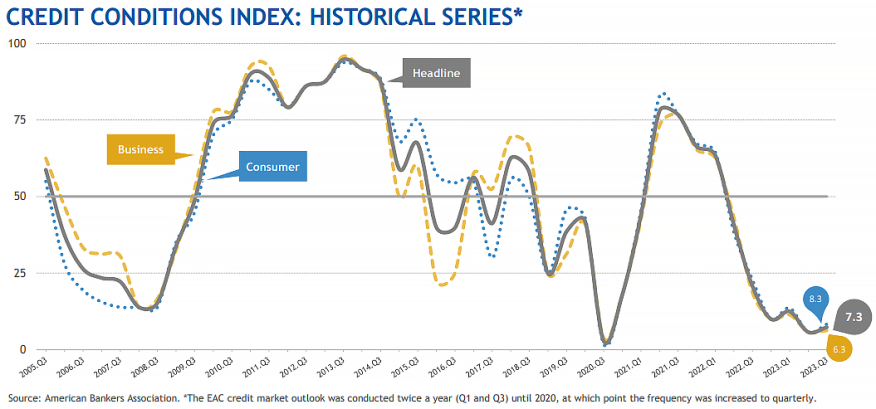

- The Consumer Credit Index increased by 2.6 points to 8.3

- The Business Credit Index rose by 0.5 to 6.3 points

- The Headline Credit Index rose by 1.5 points to 7.3

Lenders are expected to grow more cautious as credit quality and availability are projected to weaken over the next six months, according to the American Bankers Association’s (ABA) latest Q3 Credit Conditions Index.

The ABA’s Economic Advisory Committee (EAC), which includes 16 chief economists from some of North America’s largest banks, produces a quarterly credit market outlook. While indices improved marginally in the ABA’s Q3 2023 report, readings were still below 50, indicating that credit market conditions will weaken for consumers and businesses over the next two quarters.

“ABA’s latest Credit Conditions Index anticipates that lenders are preparing for weakening economic growth and increasing financial challenges for consumers and businesses as the year progresses,” ABA Chief Economist Sayee Srinivasan said. “At the same time, bank economists expect inflation to continue to ease, reducing the need for additional Fed rate hikes, and that underlying strength in the labor market will provide a buffer for consumers and businesses.”

Specifically, the Headline Credit Index rose by 1.5 points in Q3 while remaining at what economists described as “a post-pandemic low” of 7.3. Meanwhile, the Consumer Credit Index increased by 2.6 points to 8.3, and most EAC members expected both consumer credit availability and quality to worsen through the end of 2023. Similarly, the Business Credit Index now stands at 6.3 after rising by just half a point in Q3.

The Consumer and Business indices combine responses to survey questions pertaining to consumer or business credit markets, while the Headline Index pools response data from all four survey questions. Efforts by the Federal Reserve to curb inflation have pushed the Fed funds rate to its highest level since 2007, discouraging credit demand by both consumers and businesses.

EAC members expect this weakening credit quality and availability to be accompanied by slowing Gross Domestic Product growth and higher unemployment.

Job openings have fallen by 10% since the start of the year, and delinquency rates are climbing, particularly among young adults. Hiring challenges remain an obstacle for businesses as inflation eases. At the same time, slower growth and financial stress are expected to lead to weaker consumer demand and business investment in the second half of the year.