Northeastern and Midwestern regions lead annual growth, with overall equity levels rejuvenated.

Home prices hit an all-time high in June, with nearly every major market experiencing month-over-month growth, according to a report from Black Knight Inc.

The report found that affordability is nearly the worst in 37 years. However, there are many homeowners who benefitted from low interest rates locked in during the COVID era.

With several Northeast metros experiencing 5% to 8% above 2022 highs, prices have now reached new peaks in 30 of the 50 largest markets. Annual growth is the strongest in the Midwest and Northeast, while the West Coast pandemic boom markets continue to see prices run below last year’s levels.

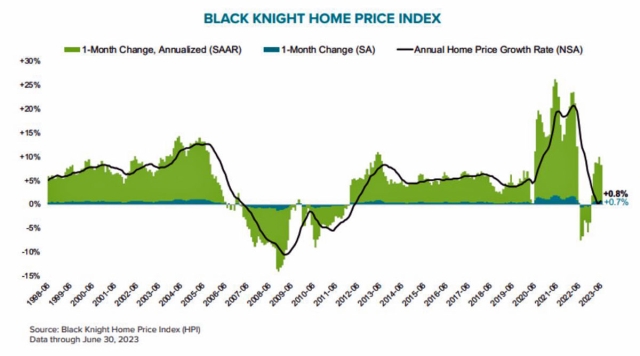

As Black Knight Vice President of Enterprise Research Andy Walden notes, "Not only has the Black Knight HPI reached a new record high, but 60% of major markets have done so as well." After 14 consecutive months of slowing, the annual growth rate jumped to 0.8% in June from a mere 0.2% in May. This trend has been tracked by Black Knight in near-real time as 2023 has progressed, showing signs of robust growth in over 80% of markets.

Rising home prices have also rejuvenated homeowner equity levels, reversing a recent retreat from 2022 highs. Total outstanding mortgage debt has surpassed $13 trillion for the first time, yet the decline in equity seen since last year's peak has largely been recovered. Overall mortgage-holder equity stands at over $16 trillion, with $10.5 trillion deemed "tappable," meaning homeowners can borrow against it while maintaining at least a 20% equity stake.

“The average mortgage holder has some $199K in tappable equity available to them; down somewhat from 2022's historic highs but still a historically large amount regardless,” Walden said. “In terms of negative equity, or 'underwater borrowers,' it's a nearly nonexistent phenomenon in today's market – just 344K homeowners currently owe more on their homes than the properties are worth. Yes, it's true that is a 70% jump from this time last year – which may sound ominous – but everything is relative. There are less than half as many underwater homeowners than there were in 2019 before the onset of the pandemic, with only 3.9% having less than 10% equity, down from 6.6% in 2019."

Despite the average unpaid principal balance of existing mortgages hitting an all-time high in June ($242K), the average interest rate on those loans sits at just 3.94%. Existing homeowners who have benefitted from $42 billion in cumulative savings through refinance in the past three years are now also benefitting from strong income growth as well.

That means most current homeowners need just 21% of their income to make their monthly mortgage payment, while prospective homebuyers need more than 36% in today’s market.