Builder Confidence Fell In Every Month Of 2022

NAHB's latest survey shows 62% of builders are using incentives to bolster sales.

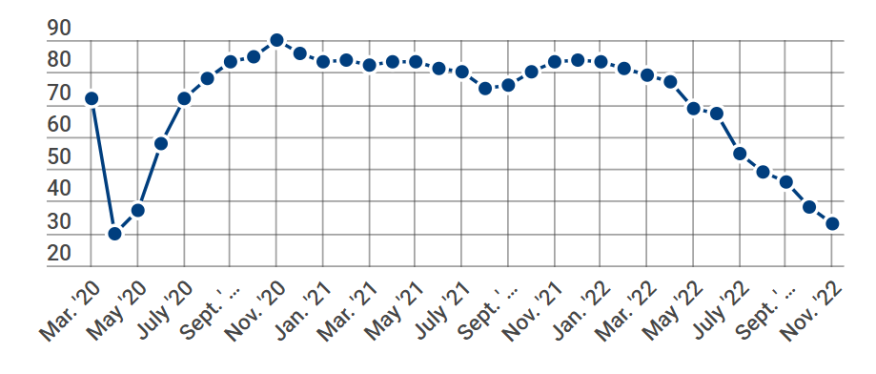

- NAHB/Wells Fargo Housing Market Index dropped two points to 31 in December, its 12th straight monthly decline.

- HMI scores fell in all four regions.

Citing high mortgage rates, construction costs well above the inflation rate, and falling consumer demand, the National Association of Home Builders (NAHB) said Monday that builder sentiment fell in every month of 2022.

The NAHB's chief economist, however, says builder confidence may be nearing the bottom of the cycle.

Builder confidence in the market for newly built single-family homes dropped two points to 31 in December, its 12th straight monthly decline, according to the NAHB/Wells Fargo Housing Market Index (HMI). It’s the lowest confidence reading since the onset of the pandemic in the spring of 2020.

The index had ended 2021 on a strong note, rising to 84 last December. It has fallen every month since.

The HMI component index gauging current sales conditions fell three points to 36 in December, while traffic of prospective buyers held steady at 20. The component charting sales expectations in the next six months, however, increased four points to 35.

Looking at the three-month moving averages for regional HMI scores, the Northeast fell five points to 37; the Midwest dropped four points to 34; the South fell six points to 36; and the West posted a three-point decline to 26.

“In this high inflation, high mortgage-rate environment, builders are struggling to keep housing affordable for home buyers,” said NAHB Chairman Jerry Konter, a home builder and developer from Savannah, Ga. “Our latest survey shows 62% of builders are using incentives to bolster sales — including providing mortgage rate buydowns, paying points for buyers, and offering price reductions.”

The percentage of builders offering incentives increased from November, when 59% offered them.

Unfortunately, Konter said, with construction costs “up more than 30% since inflation began to take off at the beginning of the year, there is little room for builders to cut prices. Only 35% of builders reduced home prices in December, edging down from 36% in November.”

The average price reduction was 8%, up from 5% or 6% earlier in the year, he said.

NAHB Chief Economist Robert Dietz said the silver lining in the latest HMI report is that “it is the smallest drop in the index in the past six months, indicating that we are possibly nearing the bottom of the cycle for builder sentiment. Mortgage rates are down from above 7% in recent weeks to about 6.3% today, and for the first time since April, builders registered an increase in future sales expectations.”

Dietz added that, in this tenuous economic climate, builders still need to plan a year or more out when thinking about land and construction timelines.

NAHB, he said, expects weaker housing conditions to persist in 2023, “and we forecast a recovery coming in 2024, given the existing nationwide housing deficit of 1.5 million units and future, lower mortgage rates anticipated with the Fed easing monetary policy in 2024.”

Derived from a monthly survey that NAHB has been conducting for more than 35 years, the NAHB/Wells Fargo HMI gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.”

NAHB then uses scores for each component to calculate a seasonally adjusted index in which any number over 50 indicates that more builders view conditions as good than poor.