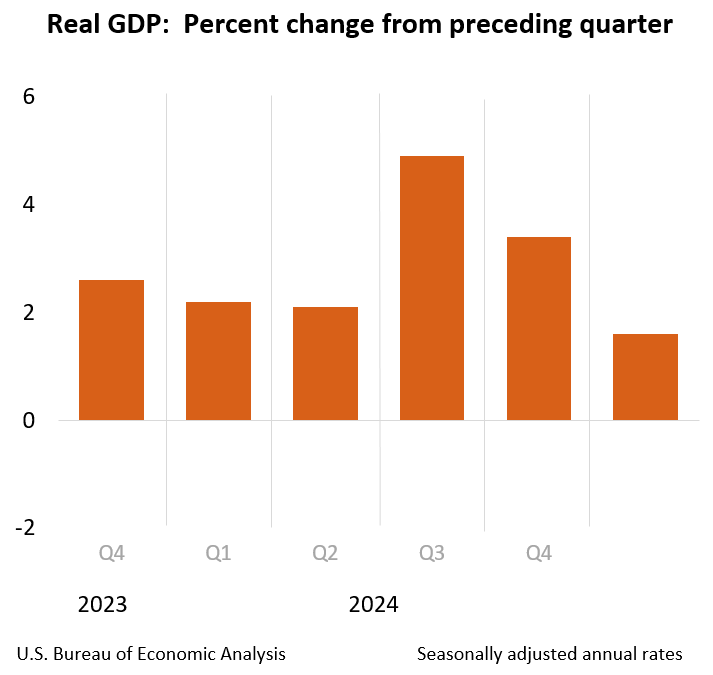

U.S. Economy Grew At 1.6% Rate In Q1

The slowdown comes at the same time that the Federal Reserve's efforts to combat inflation have stalled.

Real gross domestic product (GDP) increased at an annual rate of 1.6% in the first quarter of 2024, according to the "advance" estimate released by the Bureau of Economic Analysis (BEA) today. In the fourth quarter of 2023, real GDP, a broad measure of goods and services produced in the January-through-March period, increased 3.4%.

The subdued data suggests that the Federal Reserve's unprecedented interest rate increases are straining both consumers and the economy. Today's data reflects the lowest reading since Spring 2022.

During Q1 2024, growth in consumer spending dropped to 2.5% from the previous quarter's 3.3%. Economists had anticipated a 3% rise.

"Consumer purchases continue to drive growth in the nation's economy. While the numbers show a slight slowdown compared with last quarter, we can confidently say the economy continues to hum along," said CoreLogic Chief Economist Dr. Selma Hepp. "Inflation will likely resume its downward trend, slowly inching toward the Fed's 2% target. But, until the Fed gains greater confidence in the downward direction of inflation, it is not likely to lower rates, and overall investments in the housing sector will stay tepid, as a result.”

Per the BEA, the increase primarily reflects increases in consumer spending, residential fixed investment, nonresidential fixed investment, and state and local government spending that were partly offset by a decrease in private inventory investment. Imports, which are a subtraction in the calculation of GDP, increased.

Specifically within residential fixed investment, the increase was led by brokers’ commissions and other ownership transfer costs, as well as new single-family housing construction. The increase in nonresidential fixed investment mainly reflected an increase in intellectual property products.

"Compared to the fourth quarter, the deceleration in real GDP in the first quarter primarily reflected decelerations in consumer spending, exports, and state and local government spending and a downturn in federal government spending," the BEA said in its release. "These movements were partly offset by an acceleration in residential fixed investment. Imports accelerated."

Current‑dollar GDP increased 4.8% at an annual rate, or $327.5 billion, in the first quarter to a level of $28.28 trillion. In the fourth quarter, GDP increased by 5.1%, equating to $346.9 billion.

The price index for gross domestic purchases increased by 3.1% in the first quarter, compared with an increase of 1.9% in the fourth quarter (table 4). The personal consumption expenditures (PCE) price index increased 3.4%, compared with an increase of 1.8%. Excluding food and energy prices, the PCE price index increased 3.7%, compared with an increase of 2.0%.

The GDP estimate released today is based on source data that are incomplete or subject to further revision by the source agency. The “second” estimate for the first quarter, based on more complete source data, will be released on May 30, 2024. The Federal Reserve's next meeting to set interest rates is from April 30 to May 1. Policymakers will announce their decision at 2 p.m. ET on May 1, followed by a press conference with Fed Chair Jerome Powell at 2:30 p.m.