Comerica Waves Goodbye to Mortgage Banker Finance Business

Says move will improve liquidity and loan-to-deposit ratio.

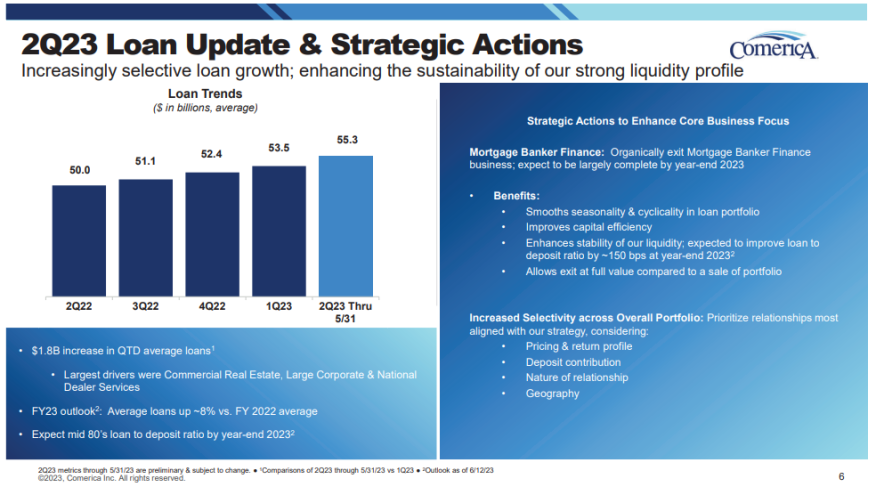

Comerica Inc. said Tuesday it will close its mortgage banker finance business, telling investors that the decision will enhance its liquidity and improve its loan-to-deposit ratio.

The Dallas-based financial services company announced its plans during a presentation Tuesday morning for the 2023 Morgan Stanley U.S. Financials, Payments & CRE Conference.

Comerica said its exit from warehouse-lending is expected to be “largely complete by year-end 2023,” and that the decision allows it to exit at full value as compared to a portfolio sale.

In its presentation, Comerica said the decision to “organically exit” its mortgage banker finance business has several benefits, including:

- Smoothing seasonality & cyclicality in loan portfolio;

- Improving capital efficiency; and

- Enhancing stability of its liquidity; expected to improve loan-to-deposit ratio by about 150 bps at year-end 2023.

According to a chart included with its presentation, Comerica’s average quarterly mortgage banker finance loan volume fell from $1.6 billion in the first quarter of 2022 to $1.1 billion in the first quarter of this year.

Bloomberg Intelligence analysts Herman Chan and Sergio Ferreira said in a research note that Comerica’s decision to exit warehouse lending “underscores the focus on building capital and liquidity.” They added that, “These loans to mortgage companies are at a cyclical low of $1.1 billion, while only $400 million in deposits suggests the business was primarily lending-oriented.”

Comerica said it has more than 55 years of experience in the mortgage banker finance business, providing warehouse financing as a bridge from “residential mortgage origination to sale to the end market.”

Comerica’s effort to improve its liquidity follows three bank failures earlier this year.

According to Reuters news service, Comerica's average deposits in the first quarter of this year fell about 5% to $67.8 billion from the previous quarter.