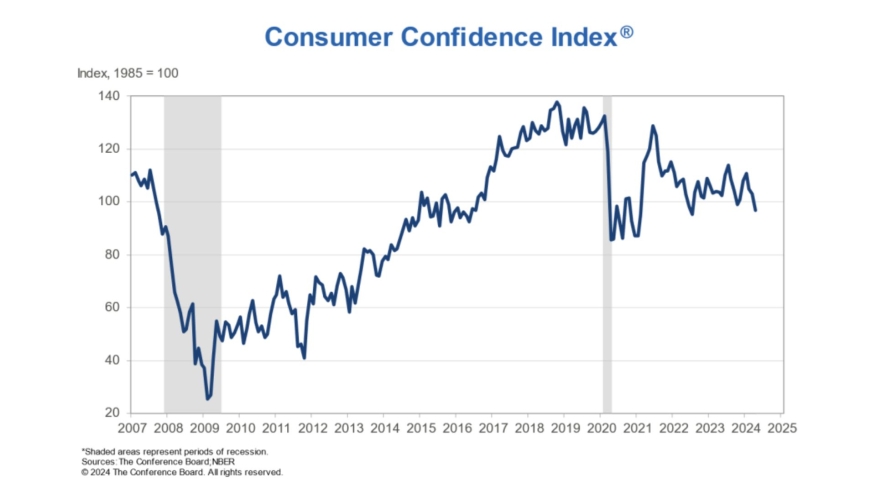

Consumer Confidence Drops To Lowest Level Since 2022

The consumer confidence index fell to 97 in April from March’s 103.1 reading.

The Conference Board Consumer Confidence Index fell for the third consecutive month in April amid worries about the labor market and income, retreating to 97 from a downwardly revised 103.1 in March.

“Confidence retreated further in April, reaching its lowest level since July 2022 as consumers became less positive about the current labor market situation, and more concerned about future business conditions, job availability, and income,” said Dana M. Peterson, chief economist at The Conference Board. “Despite April’s dip in the overall index, since mid-2022, optimism about the present situation continues to more than offset concerns about the future."

The expectations index, which measures how consumers feel about the economy, fell to 66.4 from 74 in March. A reading below 80 often signals a forthcoming recession, the Conference Board said. The expectations index has hovered around – or below – the 80 mark for nearly two years.

"In the month, confidence declined among consumers of all age groups and almost all income groups except for the $25,000 to $49,999 bracket," Peterson said. "Nonetheless, consumers under 35 continued to express greater confidence than those over 35. In April, households with incomes below $25,000 and those with incomes above $75,000 reported the largest deteriorations in confidence. However, over a six-month basis, confidence for consumers earning less than $50,000 has been stable, but confidence among consumers earning more has weakened.”

In the present tense, consumers’ assessment of current business conditions was moderately more positive in April, with 20.6% of consumers saying business conditions were “good,” up from 19.2% in March. On the other end, 17.4% said business conditions were “bad,” down from 17.6%.

Consumers were more pessimistic about the short-term business conditions outlook in April. Even though 12.8% of consumers expected business conditions to improve, that was down from 14.3% in March. On the flip side, 19.9% expect business conditions to worsen, up from 18.5%.

“According to April’s write-in responses, elevated price levels, especially for food and gas, dominated consumer’s concerns, with politics and global conflicts as distant runners-up," Peterson added. "Average 12-month inflation expectations remained stable at 5.3% despite concerns about food and energy prices. Consumers’ Perceived Likelihood of a U.S. Recession over the Next 12 Months rose slightly in April but is still well below the May 2023 peak.”