Dec. 2023 Home Prices Rose By 5.5% Year-Over-Year

Miami returns to top spot for annual price gains in large metros, at 11% in latest CoreLogic Home Price Index

U.S. home prices reached their loftiest gains in almost a year at the end of 2023, with Miami posting the highest rate of appreciation among large metropolitan areas, according to the latest CoreLogic Home Price Index (HPI).

The global property data provider’s Dec. 2023 HPI showed single-family home price growth continued its gradual momentum upwards to 5.5%. U.S. home prices have seen annual gains since early 2012.

“Last winter’s mortgage rate surge impacted seasonal home price changes in many markets and suggests that annual gains may have reached the cycle peak and will level off in the coming months,” said Dr. Selma Hepp, chief economist for CoreLogic. “But while appreciation is projected to slow, home prices will continue to extend to new highs entering the typically busy spring homebuying season. Also, while the recent dip in mortgage rates help improve some affordability challenges, additional rate declines may not arrive until the second half of 2024.”

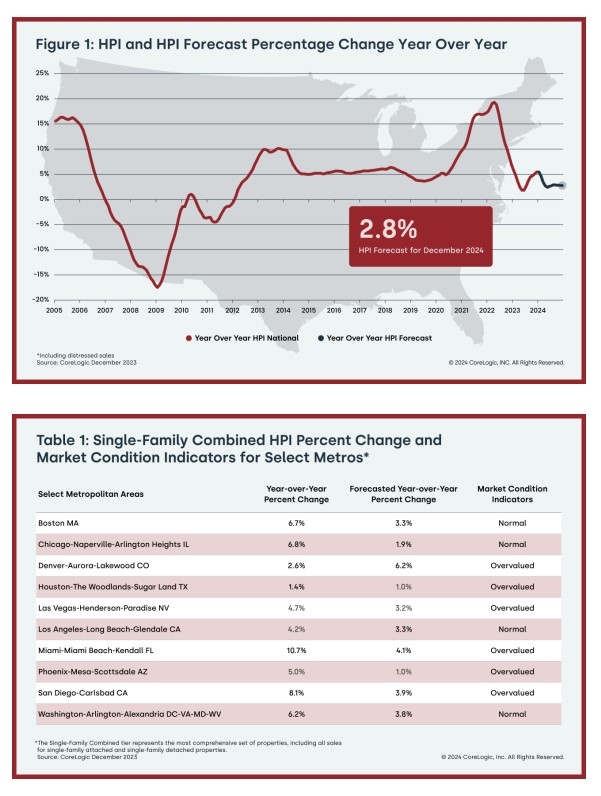

The average HPI gain for 2023 was 3.9%, down from 14.5% in 2022 but virtually equal to 2019’s annual average gain. Northeastern states continued to top the list for annual price gains, with Rhode Island in the lead at 13.3%. Among large metro areas, Miami returned to the No 1. spot YOY – posting a gain of almost 11%.

For the first time since late 2022, no states posted YOY losses. A continued demand for housing and strong mortgage performance was attributed in part to a healthy job market, in CoreLogic’s most recent Loan Performance Index report. In January 2024, the country added 353,000 new jobs, according to the U.S. Bureau of Labor Statistics.

Housing analysts are forecasting annual U.S. home price gains will slow to 2.8% in December 2024.

“The 2024 homebuying season should enjoy a boost because of pent-up demand, as well as a robust job market and wage growth,” Hepp said. “Geographic patterns in price gains continued to favor housing markets in the Northeast and the South, especially those that remain more affordable and have lagged in home price increases over the past couple of years.”

CoreLogic’s next HPI, featuring January 2024 data, is scheduled to be released March 5 at 8 a.m. EST.