Despite Recession Fears, Forbearance Rates Drop In June

A resilient labor market drove forbearance rates lower, the MBA says.

- Total loans in forbearance decreased by 5 basis points relative to May, from 0.49% to 0.44%.

- The five states with the lowest percentage of loans that were current were Mississippi, Louisiana, New York, Indiana, and West Virginia.

- 78.3% of borrowers in forbearance are in forbearance because of COVID-19- related impacts.

With the unemployment rate at 3.6% in June, American homeowners are paying their mortgages, as continued job growth supports borrowers’ ability to maintain or improve their financial health, the Mortgage Bankers Association said Monday.

The MBA released its monthly Loan Monitoring Survey for June.

“The employment situation tracks with homeowners’ ability to make mortgage payments,” says Marina Walsh, CMB, MBA’s vice president of industry analysis.

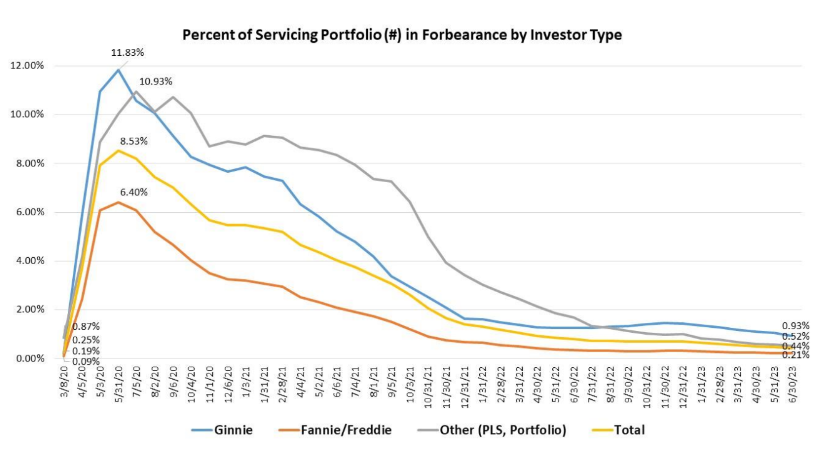

Last month, total loans in forbearance decreased by 5 basis points from May, from 0.49% to 0.44%. By investor type, the share of Fannie Mae and Freddie Mac loans in forbearance decreased 2 basis points to 0.21%, while Ginnie Mae loans in forbearance decreased 13 basis points to 0.93%. The forbearance share for portfolio loans and private-label securities (PLS) decreased 6 basis points to 0.52%.

The MBA’s survey represents 66% of the first mortgage servicing market (32.8 million loans) tracked by loan volume, not dollar volume. It covers the period from June 1-30.

Independent mortgage banks (IMBs) saw a larger month-to-month decrease of loans in forbearance than their depository counterparts, dropping 8 basis points from 0.64% in May to 0.56% in June. Depositories’ share of loans in forbearance dropped only 2 basis points, from 0.34% in May to 0.32% in June.

Mortgage forbearance is a viable option for borrowers who are struggling to make their monthly payments to pause or reduce their mortgage payments for a limited time while building back their finances.

The total loans that were current as a percent of servicing portfolio volume was unchanged from May, at 96.12%.

The five states with the highest percentage of loans that were current (not delinquent or in foreclosure) were all in the West: Washington, Idaho, Colorado, Oregon, and California. The five states with the lowest percentage of loans that were current were: Mississippi, Louisiana, New York, Indiana, West Virginia. The states where the most loans became current month-to-month were New Mexico and Oklahoma.

June’s numbers continue a years-long trend of declining forbearance rates. Since March 2020, mortgage servicers have provided forbearance to approximately 7.9 million borrowers, but the number of borrowers in forbearance has steadily declined since May 2020, when the percentage of servicing portfolios in forbearance across all investor types reached a peak of 8.53%.

The MBA’s survey also collects data on why borrowers are in forbearance. The survey found that 78.3% of borrowers are in forbearance because of COVID-19- related impacts, while another 6.1% are in forbearance because of a natural disaster. The remaining 15.6% of borrowers are in forbearance for other reasons, such as a temporary hardship caused by job loss, death, divorce, and disability.

By stage of forbearance, 34.9% of those borrowers with mortgages in forbearance are in the initial forbearance plan stage, while 54.5% are in a forbearance extension. The remaining 12.6% are forbearance re-entries, including re-entries with extensions.

Though inflation cooled sharply in June, the MBA forecasts a slowing economy through the second half of 2023 as the Fed signals additional interest rate hikes will be necessary to curb inflation. It’s widely expected that the Fed will raise interest rates another 25 basis points when officials gather on July 25 and 26.

While a slowing economy could give rise to higher unemployment, and therefore mortgage delinquencies later in the year, “forbearance remains a viable loss mitigation option for homeowners who may struggle under more challenging economic conditions,” says Walsh.

For borrowers, the drop in forbearance rates led to a slight improvement in call center answer speeds, which dropped from an average of 0.9 minutes in May to 0.8 minutes in June. Handles times, or the amount of time an agent spends handling a customer's call including the talk time, hold time, and any after-call work required, held flat from May at 8.1 minutes per caller.