FHFA Releases Q4 2023 National Mortgage Database

Lock-in effect shows signs of easing

The Federal Housing Finance Agency (FHFA) released its National Mortgage Database (NMDB) as is required by the Housing and Economic Recovery Act of 2008 to conduct a monthly mortgage market survey on the characteristics of individual mortgages, and to make the data available to the public.

The NMDB is a nationally representative 5% sample of residential mortgages in the United States. This program is designed to provide a rich source of information about the U.S. mortgage market broken down by three primary components: the National Mortgage Database (NMDB), the quarterly National Survey of Mortgage Originations (NSMO), and the annual American Survey of Mortgage Borrowers (ASMB).

The NMDB includes residential mortgage performance statistics and outstanding residential mortgage statistics.

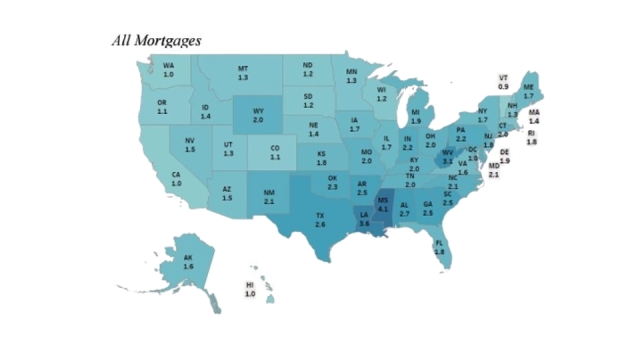

In the fourth quarter of 2023, 1.8% of all mortgages were 30 to 60 days past due on their payments, up 0.4 percentage points from last year. Only 0.6% of mortgages were 90 to 180 days past due, up 0.1 percentage point from the year past, and 0.1% of mortgages were in foreclosure, bankruptcy, or deed-in-lieu, with no change year-over-year.

Mississippi (4.1%), Louisiana (3.6%), West Virginia (3.1%), and Kentucky (0.3%) had the highest past due shares in the fourth quarter of 2023. But one New England state appears as well. Connecticut had the highest past due share among enterprise loans, at 1.1%.

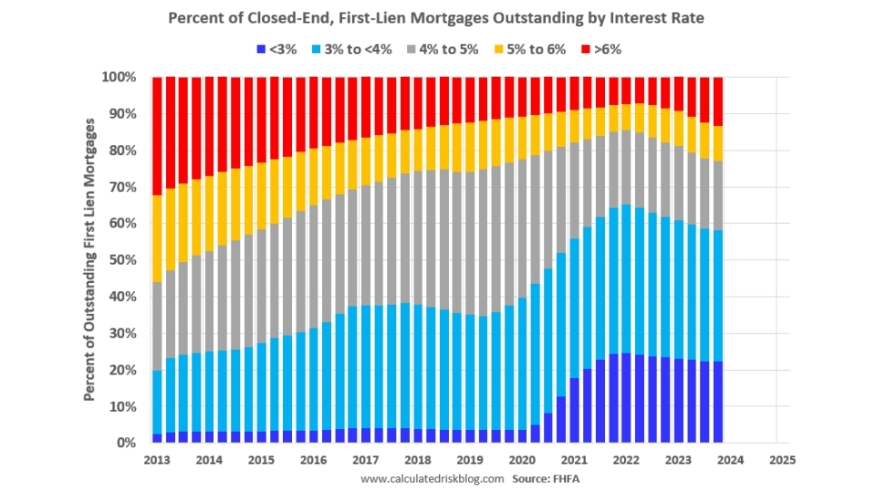

The data also shows evidence of the lock-in effect on closed-end, fixed-rate mortgages on one-to-four family properties that are outstanding. Starting in early 2020, there has been a surge in the percentage of loans under 3%, and also under 4%, since mortgage rates declined sharply during the pandemic. The percentage of outstanding loans under 4% peaked in the first quarter of 2022 at 65.3% (now at 58.1%), and the percentage of mortgages under 5% peaked at 85.6% (now at 77%). The percent of loans over 6% bottomed in the second quarter of 2022 at 7.2% and increased to 13.4% in the fourth quarter of 2023.

In all, while the lock-in effect does show signs of easing, it may take a while to fully cool off.