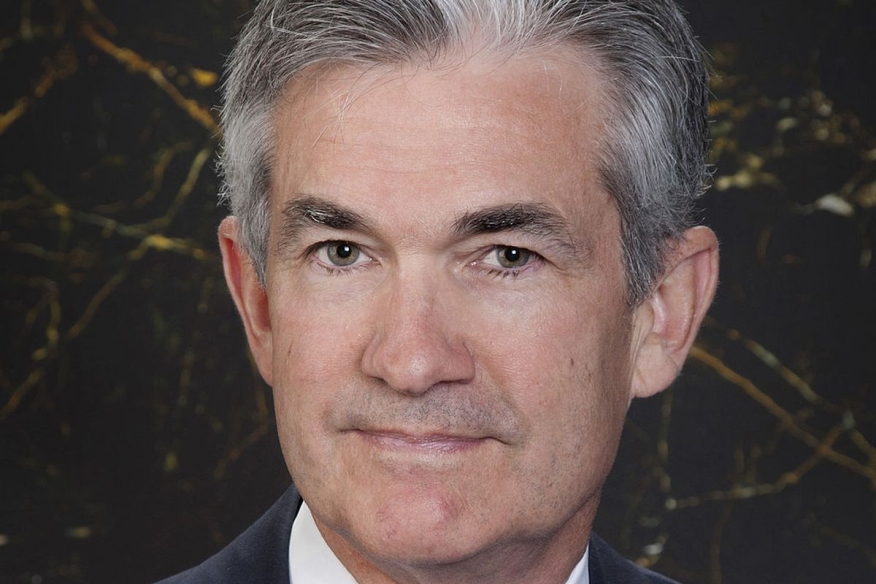

Fed Chair Maintains Firm Stance On Knocking Down Inflation

Powell emphasizes cautious approach to inflation management, despite robust economic indicators.

Federal Reserve Chair Jerome Powell hinted at more interest rate hikes Friday due to the U.S. economy's unexpected resilience. Contrary to previous remarks, where he emphasized rate hikes to manage inflation, Powell showcased a more cautious stance this time around.

"We are prepared to raise rates further if appropriate and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective," Powell said.

Powell made the remarks Friday at an annual conference of central bankers in Jackson Hole, Wyoming. Last year, at the same meeting, he warned the Fed would continue its campaign of sharp rate hikes to rein in inflation, which was near 9% at the time. Last month it eased to 3.2%, which is still not 2%.

Surprisingly, the economy has thrived despite higher loan rates, with continued growth in consumer spending. The unemployment rate remains stable at 3.5%. Although earlier this year, Wall Street analysts predicted interest rate cuts, current sentiment leans towards no cuts till at least mid-2024. Powell conceded that determining the exact borrowing cost to regulate the economy is tricky, leading to constant policy adjustments.

National Association of Realtors Chief Economist Lawrence Yun said last week at Originator Connect that he thought the Fed had been too aggressive in its rate hikes. “In my view, the Fed is overreacting,” Yun said.

Bill Bodnar, chief revenue officer for Tabrasa, said he didn't hear anything "earth shattering" from Powell.

"As a mortgage analyst, the one big takeaway is the Fed reiterated that they're going to proceed carefully going forward with rate hikes and balance sheet reduction and that the big thing is inflation, targeted at 2% is their goal, and they're going to stay until the job is done," Bodnar said.

Marty Green, a principal at Texas-based mortgage law firm Polunsky Beitel Green, offered a word of caution to those in the mortgage industry. He said that those anticipating reductions in interest rates in the immediate future may need to revisit their forecasts.

After a 22-year high benchmark rate of 5.4%, inflation has eased from 9.1% in June 2022 to 3.2%. Powell expressed satisfaction with the inflation drop but stressed that it's still higher than the Fed's 2% target. Upcoming Federal Open Market Committee (FOMC) meetings may revise the rate forecasts in light of recent milder inflation figures.

"We are navigating by the stars under cloudy skies," Powell said Friday. However, surges in bond yields, influenced by positive expectations, have led to higher mortgage, auto loan, and credit card rates. This could potentially suppress borrowing and consumer spending. Many analysts believe the Fed's last rate hike might have been in July, with long-term rates in the bond market potentially offsetting the need for more hikes.

Nevertheless, keeping rates high indefinitely could pose risks, potentially weakening the economy or even jeopardizing some banks.