CoreLogic's annual report shows 3.1% decrease in Q2 2023.

While overall risk of mortgage application fraud has decreased year-over-year, New York and Florida retained the highest risk among U.S. states for the second quarter of 2023, according to a CoreLogic report.

CoreLogic’s Annual Mortgage Fraud Report indicated fraud risk levels declined nationally by 3.1% YOY, which the company attributed in part to the recalibration of its scoring model in Q1 2022. This represents a 1.6% increase over the last quarter.

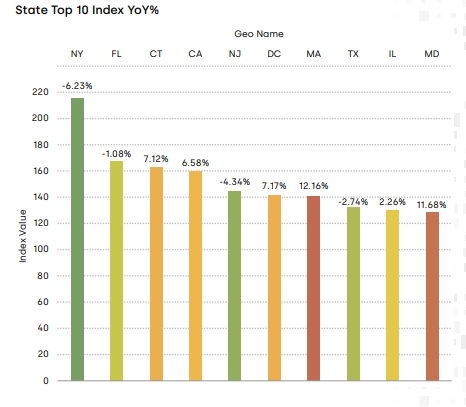

Fraud risk in New York declined by an index of 6.23% YOY and Florida dropped by 1.08%, but both were still riskier than Connecticut, which hit the third spot with a 7.12% increase, and California, number four with a 6.58% increase.

The Miami-Pompano Beach-Fort Lauderdale region is number one for mortgage application fraud among U.S. metropolitan areas, joining a total of five Florida metros in the Top 25.

“More careful loan screening due to higher repurchase risk is a primary driver of the stable levels of risk,” officials said.

Analysts estimate that .75% of all mortgage applications (approx. one in 134) contained fraud in Q2 2023.

Multi-family properties are still the highest risk segment, with one in 28 applications estimated to contain fraud.

“One trend we’ve identified to watch is the increase in occupancy misrepresentation. This type of fraud typically occurs when an investor identifies an investment property as a primary residence to obtain more favorable rates,” officials said, adding that suspect occupancy loans have nearly tripled since 2020. “To combat this risk, we recommend increased scrutiny of loans that score in the high-risk range of our predictive fraud risk score. Our analysis found that these loans are more than twice as likely to have indications of occupancy misrepresentation.”

The report includes detailed data for six fraud type indicators that complement the national index: identity, income, occupancy, property, transaction, and undisclosed real estate debt.