Freddie Mac: Mortgage Rates Jumped Last Week

30-year fixed mortgage moves up to 5.51%

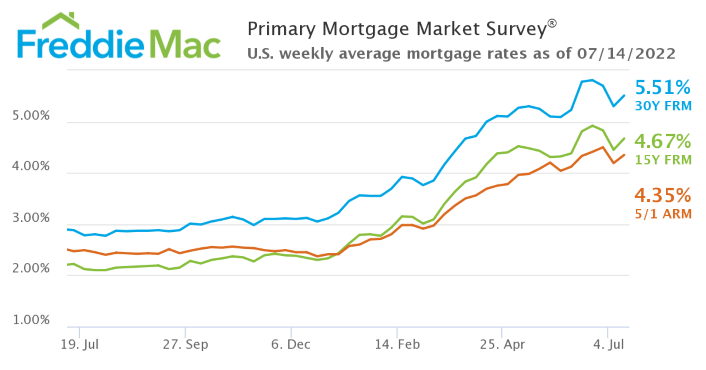

In a possible signal of what might be coming, given that inflation is now 9.1%, the 30-year, fixed-rate mortgage jumped 5.51% last week, up from 5.3%, according to Freddie Mac’s Primary Mortgage Market Survey, which was released today.

A year ago this time, the 30-year fixed-rate mortgage was 2.88%.

“Mortgage rates are volatile as economic growth slows due to fiscal and monetary drags,” said Freddie Mac Chief Economist Sam Khater. “With rates the highest in over a decade, home prices at escalated levels, and inflation continuing to impact consumers, affordability remains the main obstacle to homeownership for many Americans.”

The average for 15-year fixed-rate mortgages (FRMs)was 4.67% with an average 0.8 point, up from last week when it averaged 4.45%. A year ago at this time, 15-year FRMs averaged 2.22%.

“This year’s summer housing markets are feeling the heat of record-high home prices on top of scorching inflation at a 40-year high," said Realtor.com, Senior Economist George Ratiu. "As households pay much more for cars, clothing, food, gasoline, and services, there are fewer dollars left over from each paycheck at a time when housing affordability is a growing challenge. For a household with a $75,000 income, only 23% of homes on the market are affordable, down from 50% of inventory in 2018.”

Ratiu added, “While these trends are resulting in a cooler summer homebuying season than usual, the road ahead points towards a promising shift, away from 2021’s severe undersupply and win-at-all-costs competition. As the Fed continues to fight inflation, borrowing costs will keep rising, cooling demand at a time when we’re seeing more homes for sale. In turn, prices will continue to adjust to a new equilibrium.”

The U.S. Bureau of Labor Statistics released the Consumer Price Index, often considered the rate of inflation, yesterday, saying it’s 9.1%, the highest inflation rate in 40 years.

The Federal Open Market Committee, which sets the Federal Funds rate, the interest rate that banks lend to one another for overnight loans so they’re fully capitalized, meets on July 26th and 27th. It’s expected that they’ll raise the Federal Funds rate at the meeting.