Freddie Mac Predicts Little Growth In US Economy Until 2024

Total mortgage originations will remain flat for remainder of the year

Freddie Mac’s “Economic, Housing, and Mortgage Market Outlook” for August 2023 predicts mortgage originations to remain flat through December 2023 (due in part to a decimated refinance market), muted home sales for the rest of 2023, home prices will grow slightly over the next 12 months, and a softening labor market.

Key observations from the report:

- U.S. economic growth remains on firm ground, with strong consumption spending and a tight labor market.

- Although housing market activity has slowed, a demand/supply imbalance in the U.S. is causing a rebound in home prices.

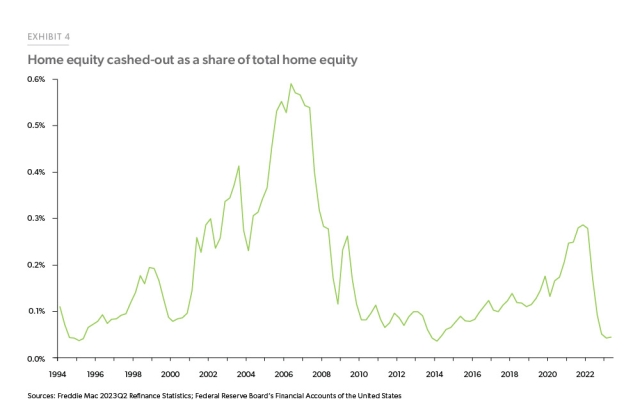

- Refinance origination activity in the first half of 2023 is the lowest in almost 30 years, mainly limited to those cashing out home equity.

What follows is the language from Freddie Mac’s August 2023 outlook.

The Outlook

The better-than-expected economic growth in the year's first half signals that the U.S. economy continues to grow above trend. However, the macroeconomic outlook is still uncertain as the Federal Reserve may continue with rate hikes through the rest of this year.

Currently, there is a 60% probability that there will be no more rate hikes according to the futures markets, with a quarter of the analysts expecting the Fed to raise rates by another quarter point in the September meeting, and only 2% expecting the year to end in the 5.75-6% target range for the Fed funds rate. The economic risks are weighted to the downside until the Fed completes its tightening cycle.

There are detractors to that point of view in light of the release this week of the July minutes from the most recent rate hike by the Feds. Bill Bodnar, chief revenue officer for Tabrasa, which provides mortgage market insights, said, “The minutes told us nothing. And only added uncertainty. They talked out of both sides of their mouth regarding the future of rate hikes. They said inflation was too high but acknowledged the risk of over-tightening. They also said no recession, which was also bond-unfriendly. They likely won’t hike in September but could come back in November [with a hike].”

Mortgage Originations

Mortgage origination volume depends on home sales, prices, and refinance activity. While we expect prices to remain high, we forecast sales to remain low and refinance activity to stay muted this year.

In the first half of 2023, nearly nine out of 10 conventional refinance originations were cash-out refinances, demonstrating just how few rate-and-term refinance borrowers exist in the current market. The faster pace of decline in the rate-and-term refinance originations is pushing up the cash-out refinance share even as the overall refinance volumes decline.

Therefore, we expect total mortgage originations to remain flat for the rest of the year. We expect purchase originations to resume modest growth in 2024 as rates moderate and more existing homes hit the market to facilitate sales activity.

Home Sales

The combination of high-interest rates and tight inventory due to the rate lock-in effect will keep home sales low through 2023. Our forecast is for mortgage interest rates to remain above 6% for the rest of the year, and we do not expect a lot more existing homes to come onto the market. Therefore, we expect home sales to remain muted for the rest of the year.

Home Prices

Our corporate forecast for the next 12 months has house prices rising by 0.8% and an additional 0.9% over the following 12 months, consistent with our projection of a gradually softening labor market. This is more optimistic than earlier in the year mainly due to the rebound in prices after the house price declines in the second half of 2022.

We believe the rebound in prices is driven by a combination of very tight supply and the large cohort of Millennial first-time homebuyers reaching prime homebuying age. It is evident that despite affordability issues, there is tremendous demographic-driven demand for houses relative to supply, which will continue to keep upward pressure on prices. We expect the labor market to gradually soften without a major adverse effect on the economy.

General Economy, Rates, Inflation

Consumers are the backbone of the U.S. economy and have been on a spending spree, but that is likely to moderate as consumer balance sheets shrink, partly due to moderating yet still persistent inflationary pressure and high interest rates. The economy will continue to grow if consumer spending remains undeterred. But there is a risk that if inflation remains sticky and interest rates keep rising, the labor market could weaken, and the economy will start shrinking. That said, we expect inflation to cool, although at a slower pace, and remain above the Fed’s target of 2% through next year.

Putting all this together, our baseline forecast remains the same; we expect the labor market to gradually soften without a major adverse effect on the economy.