Freddie Mac Reports 30-Year Fixed-Rate Mortgage Averages 6.62%

Experts predict potential downward drift in mortgage rates, but many prospective buyers seek lower rates to enter the market.

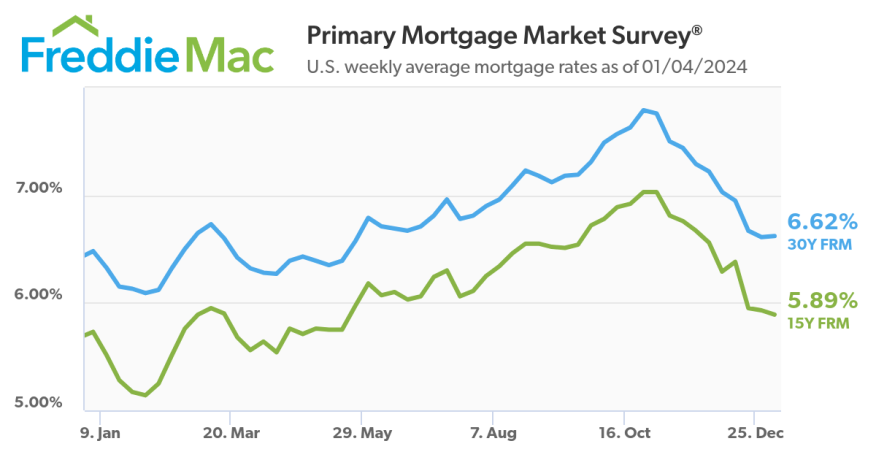

Despite the optimism of a new year, Freddie Mac reported that the 30-year fixed-rate mortgage (FRM) averaged 6.62% last week.

“Between late October and mid-December, the 30-year fixed-rate mortgage plummeted more than a percentage point. However, since then, rates have moved sideways as the market digests incoming economic data,” Freddie Mac’s Chief Economist Sam Khater said.

The 30-year FRM averaged 6.62% as of Jan. 4, 2024, up slightly from last week when it averaged 6.61%. A year ago, the 30-year FRM averaged 6.48%.

The 15-year FRM averaged 5.89%, down from last week when it averaged 5.93%. A year ago at this time, the 15-year FRM averaged 5.73%.

“Given the expectation of rate cuts this year from the Federal Reserve, as well as receding inflationary pressures, we expect mortgage rates will continue to drift downward as the year unfolds. While lower mortgage rates are welcome news, potential homebuyers are still dealing with the dual challenges of low inventory and high home prices that continue to rise,” Khater added.

Hannah Jones, an economic research analyst for Realtor.com, said only 11% of prospective buyers say anything below 7% is enough to make it feasible for them to purchase their next home.

"Though the recent decline in rates has inspired optimism, 12% of prospective homebuyers say rates would need to dip below 6% and more than one-quarter (28%) say rates would need to dip below 4% to bring them into the market," Jones said. "The typical outstanding mortgage has a rate of less than 4%, more than 2.5 percentage points below today’s rate. This gap is likely to keep many sellers on the sidelines, waiting for mortgage rates to come down further."