Growing Housing Inventory Dampens Competition: Redfin

While new listings dropped 12%, overall housing supply is growing, giving buyers more choices.

- New listings of homes for sale dropped 12% year over year during the four weeks ending Aug. 7, the steepest decline since June 2020.

- Pending home sales are down 16% from a year ago.

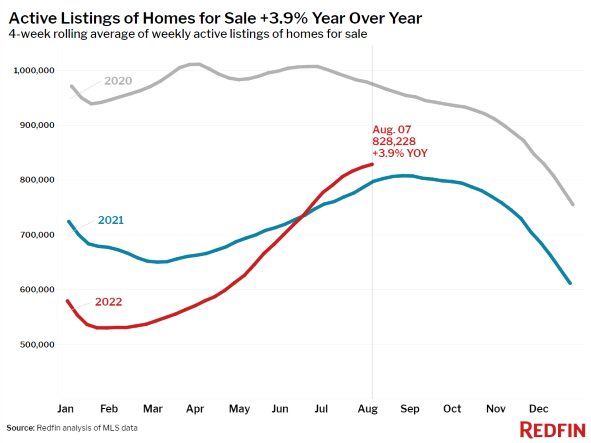

- Despite the decrease in new listings, the overall housing supply continues to grow; number of homes for sale is up 4% year over year.

- Nationwide, 44.3% of home offers written by Redfin agents faced competition, the sixth-straight decline and the lowest share on record.

The scales of the housing market are tipping toward buyers.

More homeowners are holding off on selling as the housing market cools, fueling the largest decline in home listings in more than two years, according to a new report from Redfin.

Still, the overall inventory of homes has risen year over year, and that’s giving homebuyers more choices, resulting in the sixth-consecutive monthly decline in competition for the homes that are for sale, according to a separate report from Redfin, the technology-powered real estate brokerage.

Nationwide, 44.3% of home offers written by Redfin agents faced competition on a seasonally adjusted basis in July, compared to a revised rate of 50.9% one month earlier and 63.8% one year earlier, Redfin said.

That’s the lowest share on record, with the exception of April 2020, when the onset of the coronavirus brought the housing market to a near standstill, Redfin said.

The typical home in a bidding war received 3.5 offers in July, compared with 4.1 one month earlier and 5.3 a year earlier, according to data submitted by Redfin agents nationwide. Redfin’s bidding-war data goes back through April 2020.

Homebuyer competition is cooling as more Americans are priced out of the housing market due to higher mortgage rates and inflation, Redfin said. Properties are lingering on the market longer and the housing shortage is easing up, giving buyers more options to choose from and room to negotiate. Some sellers are slashing their asking prices as a result. Roughly 8% of listings on the market each week experience a price cut, the highest share on record.

“The market is wildly different than it was a few months ago. Buyers are competing with one to two other offers instead of four to eight. Some aren’t facing competition at all,” said Alexis Malin, a Redfin real estate agent representing buyers in Jacksonville, Fla. “There’s not the same sense of urgency. House hunters are scheduling tours four days in advance instead of one, and they’re becoming much more selective. If a home doesn’t check all of their boxes, they’re waiting until they find one that does. Six months ago, buyers were taking any house they could get.”

It’s also causing some sellers to delay listing their homes. Redfin said Thursday that new listings of homes for sale dropped 12% year over year during the four weeks ending Aug. 7, the steepest decline since June 2020.

Homeowners are staying put in part, Redfin said, because homebuyer demand has slowed due to higher mortgage rates; pending home sales are down 16% from a year ago. Some homeowners are also experiencing an effect called "rate lock in," in which they're hesitant to buy a new home since it would mean paying a significantly higher mortgage rate, the company said.

And yet, despite the decrease in new listings, the overall housing supply continues to grow — a sign that homebuyers are pulling back more than home sellers, Redfin said. The total number of homes for sale is up 3.8% year over year, good news for the buyers who can afford to remain in the market, because it means the housing shortage is easing and there are more homes to choose from.

“Buyers are backing off due to rising housing costs and sellers are holding back because they realize they won't get the bidding war they would have gotten six months ago,” said Redfin Deputy Chief Economist Taylor Marr. “The good news is, this is bringing balance to the market. If mortgage rates resume their downward trajectory, more buyers and sellers could get back in the game.”

Redfin also offered these leading indicators of homebuying activity:

- For the week ending Aug. 11, 30-year mortgage rates rose to 5.22%. This was still down from a 2022 high of 5.81%, but up from 3.11% at the start of the year.

- The latest Home Purchase Sentiment Index from Fannie Mae indicates that the share of people who believe now is a good time to sell is rapidly declining.

- Fewer people searched for “homes for sale” on Google — searches during the week ending Aug. 6 were down 23% from a year earlier, but up 12% from late May.

- The seasonally adjusted Redfin Homebuyer Demand Index — a measure of requests for home tours and other home-buying services from Redfin agents — was down 9% year over year during the week ending Aug. 7, but is up 17% from the week of June 19.

- Touring activity as of Aug. 7 was down 7% from the start of the year, compared to a 15% increase at the same time last year, according to home tour technology company ShowingTime.

- Mortgage purchase applications were down 19% from a year earlier during the week ending Aug. 5, while the seasonally adjusted index was down 1% week over week.

Key housing market takeaways for 400+ U.S. metro areas:

Unless otherwise noted, this data covers the four-week period ending Aug. 7.

- The median home sale price was $379,089, up 8% year over year. Prices have declined 4.1% from the record high of $395,500 hit during the four-week period ending June 19. A year ago, they rose 0.7% during the same period.

- Only two metro areas saw a year-over-year decline in the median home sale price: Oakland, Calif., where prices fell 1.5% to $940,994, and San Francisco, where prices were down 2.4% to $1,502,500.

- The median asking price of newly listed homes increased 12% year over year to $390,750. Asking prices are down 3.5% from the all-time high set during the four-week period ending May 22. Last year during the same period they were down just 0.3%.

- The monthly mortgage payment on the median asking price home hit $2,290 at the current 5.22% mortgage rate, up 37% from $1,668 a year earlier, when mortgage rates were 2.87%. That’s down slightly from the peak of $2,464 reached during the four weeks ending June 12.

- Active listings (the number of homes listed for sale at any point during the period) rose 4% year over year.

- 38% of homes that went under contract had an accepted offer within the first two weeks on the market, down from 45% a year earlier.

- 26% of homes that went under contract had an accepted offer within one week of hitting the market, down from 31% a year earlier.

- Homes that sold were on the market for a median of 22 days, up from 20 days a year earlier and the record low of 16 days set in May and early June.

- 43% of homes sold above list price, down from 52% a year earlier.

- On average, 7.8% of homes for sale each week had a price drop, a record high.

- The average sale-to-list price ratio, which measures how close homes are selling to their asking prices, declined to 100.6% from 101.7% a year earlier. In other words, the average home sold for 0.6% above its asking price.

Redfin serves more than 100 markets across the U.S. and Canada and employs over 6,000 people. Its weekly housing market data goes back through 2015.