Home Affordability Improves In 47 States

Affordability conditions improved modestly in most of the country in July.

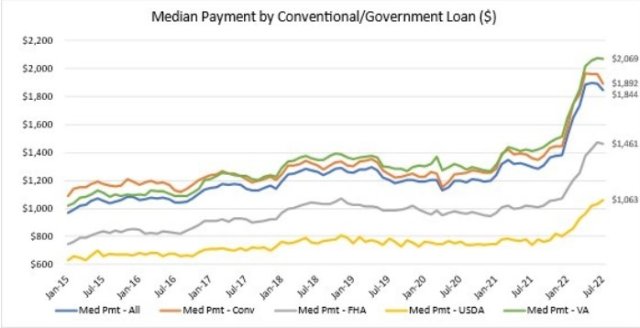

- The national median payment by applicants decreased to $1,844 from $1,893 in June.

- The national PAPI fell 3.8% in July, meaning payments on new mortgages take up a smaller share of a typical person’s income.

- Mortgage payments for home purchases have increased relative to rents.

- Homebuyer affordability improved for all homebuyer demographics in the past two months.

Home affordability is making a small comeback, improving for the second consecutive month in July. The national median payment by applicants decreased to $1,844 from $1,893 in June.

The Mortgage Bankers Association's (MBA) Purchase Applications Payment Index (PAPI), measures how new monthly mortgage payments vary across time relative to income. A decrease in the PAPI indicates an improvement in borrower affordability conditions, occurring when loan application amounts decrease, mortgage rates decrease, or earnings increase.

“Affordability conditions improved modestly in most of the country in July, as slightly lower mortgage rates and a decrease in the median loan amount led to the typical homebuyer’s mortgage payment falling $49 from June,” said MBA Associate Vice President of Housing Economics Edward Seiler. “Homebuyer demand has faltered this summer, as lingering economic uncertainty, high inflation, and still-high mortgage rates caused many prospective buyers to delay their home search. The combination of a strong job market and moderating home-price growth could entice some of these buyers to return in the coming months.”

The national PAPI fell 3.8% to 157.7 in July from 163.9 in June, meaning payments on new mortgages take up a smaller share of a typical person’s income. Compared to July 2021 (116.6), the index jumped 35.2%. For borrowers applying for lower-payment mortgages (the 25th percentile), national mortgage payments decreased between June and July 2022 from $1,241 to $1,210.

The top five states with the lowest PAPI were: Washington, D.C. (101.4), Connecticut (105.1), Alaska (110.3), Louisiana (110.9), and West Virginia (116.6). Meanwhile, the top five states with the highest PAPI were: Idaho (250.8), Nevada (249.6), Arizona (230.5), Utah (209.9) and Florida (201.1).

At the end of the second quarter (June 2022), MBA’s national mortgage payment to rent ratio (MPRR) increased to 1.44 from 1.38 at the end of the first quarter (March 2022). This means mortgage payments for home purchases have increased relative to rents.

The national median asking rent in the second quarter of this year increased 4.7% to $1,314 from $1,255 in the first quarter. The 25th percentile mortgage application payment to median asking rent ratio was 0.94 in June, up from 0.90 in March.

“Rent growth has remained incredibly strong in recent quarters, but the influx of new developments coming onto the market should alleviate some of the affordability pressures that are affecting renters in many parts of the country,” added Seiler.

Homebuyer affordability improved for all homebuyer demographics in the past two months. Affordability increased for Black households with the national PAPI decreasing from 159.2 in June to 153.1 in July. Affordability increased for Hispanic households with the national PAPI decreasing from 154.9 in June to 149 in July. For White households, homebuyer affordability increased with the national PAPI decreasing from 164.7 in June to 158.5 in July.