Home Affordability Took Another Hit In April

MBA's affordability index finds mortgage application payments rose 0.9% to $2,112.

- The national median mortgage payment was $2,112 in April, up from $2,093 in March and up 11.8% YOY.

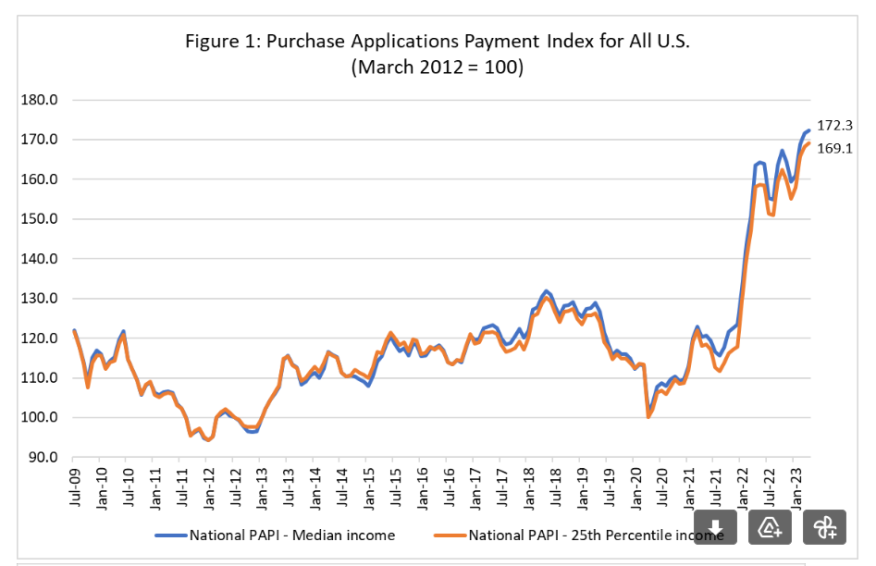

- The national PAPI hit a record high in April, rising 0.5% to 172.3 in April from 171.5 in March.

It became a little more expensive in April to buy a home, the Mortgage Bankers Association (MBA) said Thursday.

The national median payment applied for by people applying to buy a home increased to $2,112 in April, up 0.9% from $2,093 in March, according to the MBA’s Purchase Applications Payment Index (PAPI). The index measures how new monthly mortgage payments vary across time, relative to income, using data from the MBA’s Weekly Applications Survey (WAS).

“Homebuyer affordability eroded further in April, with both the typical borrower monthly payment and median purchase amount rising due to higher rates and home prices,” said Edward Seiler, MBA's associate vice president, Housing Economics, and executive director, Research Institute for Housing America. “Elevated interest rates and low housing supply have kept many prospective borrowers on the sidelines. However, MBA expects mortgage rates to stabilize and inventory levels to improve, which should incentivize some buyers to reenter the market.”

An increase in MBA’s PAPI — which indicates declining borrower affordability conditions — means that the mortgage payment-to-income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. A decrease in the PAPI — a sign of improving borrower affordability conditions — occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

The national PAPI hit a record high in April, rising 0.5% to 172.3 in April from 171.5 in March. The index is up 5.3% year over year, from 163.6 in April 2022, the MBA said.

For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment increased 1.35% to $1,430 in April, from $1,411 in March.

The Builders’ Purchase Application Payment Index (BPAPI) showed that the median mortgage payment for purchase mortgages in MBA’s Builder Application Survey decreased 2.5% to $2,445 in April compared to $2,508 in March.

MBA’s national mortgage payment-to-rent ratio (MPRR) decreased from 1.45 at the end of the fourth quarter last year to 1.43 at the end of the first quarter of 2023), meaning mortgage payments for home purchases have decreased relative to rents.

According to the Census Bureau’s Housing Vacancies and Homeownership Survey, the national median asking rent in the first quarter of this year increased 10.5% on a quarterly basis to $1,462, from $1,322 in fourth-quarter of 2022. The 25th percentile mortgage application payment to median asking rent ratio remained flat at 0.96 in March from the previous quarter.

Other Key Findings of MBA's PAPI for April 2023:

- The national median mortgage payment was $2,112 in April, up from $2,093 in March and from $2,061 in February. It is up $223 from a year ago, an 11.8% increase.

- The national median mortgage payment for FHA loan applicants was $1,750 in April, down from $1,755 in March and up from $1,374 in April 2022.

- The national median mortgage payment for conventional loan applicants was $2,170, up from $2,145 in March and from $1,967 in April 2022.

- The top five states with the highest PAPI were: Idaho (255.6), Nevada (246.3), Arizona (226.1), Florida (216.6), and California (213.9).

- The five states with the lowest PAPI were: North Dakota (116.4), Connecticut (124.4), Louisiana (129.3), West Virginia (131.9), and D.C. (133.5).

- Homebuyer affordability decreased for Black households, with the national PAPI increasing from 175.8 in March to 176.6 in April.

- Homebuyer affordability decreased for Hispanic households, with the national PAPI increasing from 160.2 in March to 161.0 in April.

- Homebuyer affordability decreased for White households, with the national PAPI increasing from 172.2 in March to 173.0 in April.