Home Prices Saw YoY Increases In Latest CoreLogic Report

CoreLogic's projections suggest a continued rise but at a slower pace through 2025.

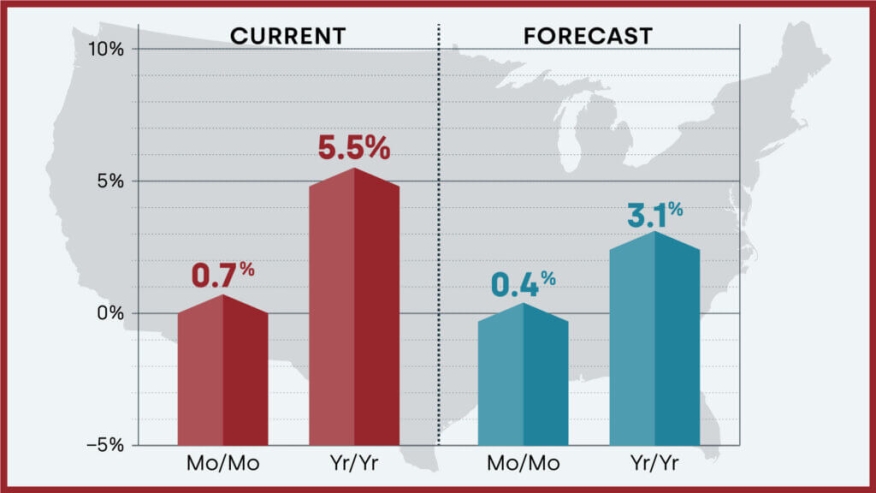

- On a month-over-month basis, home prices grew by 0.7% in February 2024 compared with January 2024.

U.S. annual home price growth remained mostly consistent with numbers seen since last fall during February, per CoreLogic’s latest U.S. Home Price Insights report, released Tuesday.

Home prices nationwide, including distressed sales, increased year over year by 5.5% in February 2024 compared with February 2023. On a month-over-month basis, home prices grew by 0.7% in February 2024 compared with January 2024.

Idaho was the only state to post a small annual home price decline. The states with the highest increases YOY were South Dakota (13.8%), New Jersey (12.5%) and Rhode Island (11.6%).

Miami posted the highest year-over-year home price increase of the country’s 10 highlighted metro areas in January, at 10.2%. San Diego saw the next-highest gain at 9.9%.

The forecast also predicts that home prices will rise by 0.4% from February 2024 to March 2024 and increase by 3.1% on a year-over-year basis from February 2024 to February 2025.

CoreLogic projects that YOY home price gains will continue to rise at a slower pace for the rest of 2024, which suggests more certainty for potential homebuyers who have been waiting to get a foot in the door. As noted in the most recent U.S. CoreLogic S&P Case-Shiller Index report, an increase in for-sale inventory also benefits potential homebuyers, though affordability remains a concern, particularly if mortgage rates remain elevated throughout the spring homebuying season.

“Home price growth pivoted in February, as the impact of the January 2023 Home Price Index bottom finally faded,” said Dr. Selma Hepp, chief economist for CoreLogic. “As a result, the U.S. should begin to see slowing annual home price gains moving forward.”

“Nevertheless,” Hepp continued, “with a 0.7% increase from January to February 2024, which is almost double the monthly increase recorded before the pandemic, spring home price gains are already off to a strong start despite continued mortgage rate volatility. That said, more inventory finally coming to market will likely translate to more options for buyers and fewer bidding wars, which typically keeps outsized price growth in check. Still, despite affordability challenges, homebuyer demand appears to favor already expensive, coastal markets with a limited availability of properties for sale.”