NAR is the largest lobbyist group in the world. In every mortgage continuing education class I have attended, mortgage professionals have questioned why agents receive more favorable treatment or exclusions from rules. Perhaps because of this feeling of unfairness, many of those mortgage professionals silently cheered when they initially heard about the ruling, not realizing this may negatively affect them as much as the agents.

It is likely Realtors will find a workaround that will help them maintain the status quo with the maximum commissions, making homebuyers the biggest losers. Government loan programs do not allow for the seller concession to be used to pay for the buyer’s agent commission fees. New homeowners will need informed advice from a trusted mortgage professional to help guide them through the process, especially if the buyer’s agent insists that they pay the commission directly either with cash or seller concession funds.

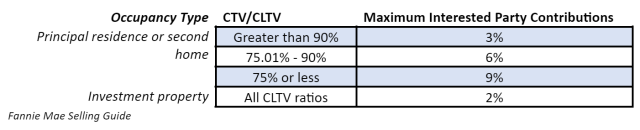

Seller concessions are restricted depending on the loan program and the amount of the buyer’s downpayment. FHA allows for up to 6% seller contribution based on the sales price. USDA allows for up to 6 percent of the appraised value. VA allows the seller a maximum of 4% in seller contributions. The chart below reflects the conventional limits on seller contributions.

The average commission for a buyer’s agent ranges from 2.5 to 3%. If you deduct the buyer’s agent commission from the seller’s contribution, almost nothing is left to cover the homebuyer’s closing costs. This has the potential to impact unsavvy first-time homebuyers the most, as they often rely on a buyer’s agents to guide them and represent them in the home buying process.

Government loan programs do not allow the seller contributions to pay for real estate commissions. Mortgage professionals will be conflicted between recommending a conventional loan program just to be able to access the maximum amount of seller contributions to help them get into a home. But then you need to weigh in the costs of monthly PMI.

This ruling may also lead to additional TRID complications as MLOs may need to disclose the real estate commission on the Loan Estimate (LE). Under federal regulation 1026.37(g)(4), if the mortgage loan originator is aware of any “other” costs related to the real estate transaction, they should clearly be disclosed on the LE.

“Under the subheading “Other,” an itemization of any other amounts in connection with the transaction that the consumer is likely to pay or has contracted with a person other than the creditor or loan originator to pay at closing and of which the creditor is aware at the time of issuing the Loan Estimate, a descriptive label of each such amount, and the subtotal of all such amounts.”

So, what happens when the real estate contract does not disclose who will be paying the real estate commissions or how the seller contributions will be allocated for the closing costs? Mortgage loan originators may need to decide how to distribute the seller contributions on the final CD. However, that may become a liability to the MLO. Under federal regulation 1026.38 (j)(2)(v):

“General seller credits. When the consumer receives a generalized credit from the seller for closing costs or where the seller (typically a builder) is making an allowance to the consumer for items to purchase separately, the amount of the credit must be disclosed. However, if the seller credit is attributable to a specific loan cost or other cost listed in the Closing Cost Details tables, pursuant to § 1026.38(f) or (g), that amount should be reflected in the seller-paid column in the Closing Cost Details tables under § 1026.38(f) or (g).”

If your borrowers are using a buyer’s agent, it will be important for them to communicate the best use of those seller contributions, articulate where those closing costs will benefit the overall transaction, and include that in the real estate contract. If not, prepare to be asked by your borrower to help them negotiate the buyer’s agent’s commission down so that they can cover more of their closing costs.