ICE Report: December 2023 Delinquency Rate Hits 3.57%

Unusual Sunday month-end contributes to delinquency increase; serious delinquencies dip, foreclosures reach 18-month low, and prepayments rise in housing market.

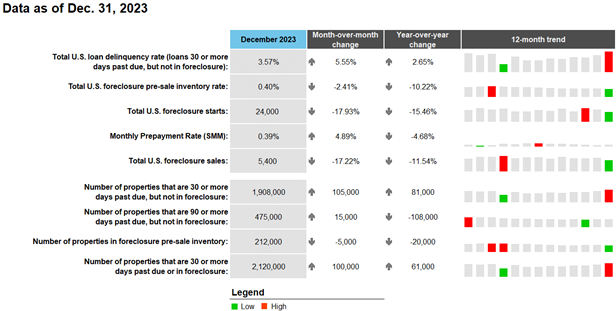

In December 2023, the national delinquency rate experienced a slight increase, reaching 3.57%, according to the Intercontinental Exchange, Inc. (ICE) mortgage performance report.

This uptick of 19 basis points (bps) from November was primarily attributed to the fact that December ended on a Sunday. This unusual calendar occurrence delayed the processing of payments made on the last day of the month, impacting the delinquency rate.

While the rise in delinquencies for December 2023 of 5.6% was larger than the average December increase of 1.4%, it was still milder compared to previous December months ending on a Sunday, which typically saw delinquencies jump by an average of 9.9%.

Delinquencies showed a moderate increase across the board, driven by higher inflows and rolls to later stages of delinquency. However, there was some positive news as cures from both early- and late-stage delinquency improved.

Despite the rise in delinquencies, serious delinquencies (those 90 days or more past due) increased to 475,000. However, this figure was still 19% lower than the number reported at the end of December 2022.

December 2023 also witnessed a noteworthy development in foreclosure activity. There were 24,000 foreclosure starts during the month, marking an 18-month low in new foreclosure activity. The total number of active foreclosures was the lowest since March 2022, with 212,000 active foreclosures reported, which was still 25% below (-71,000) pre-pandemic levels.

Additionally, foreclosure sales (completions) in December numbered 5,400, reflecting a decrease of 17.2% from November. This figure represented the fewest foreclosure completions since February 2022, shortly after the end of COVID-era moratoria.

In addition, prepayment activity increased by 4.9% in December, resulting in a single-month mortality rate of 0.39%. This rise in prepayments was influenced by improving interest rates. However, prepayment activity remained constrained by both seasonal factors and affordability pressures in the housing market.