Improving Rates And Favorable Demographics Drive Hope For A Mortgage Rebound

Anticipating an increase in mortgage volume driven by improving rates and favorable demographics.

With 2023 in the rearview mirror, experts in the industry spent time last week talking about why 2023 was so bad and why they're more optimistic about 2024.

"It's been an extraordinarily tough year in 2023," Mortgage Bankers Association Chief Economist Michael Fratantoni said during a webinar sponsored by SnapDocs.

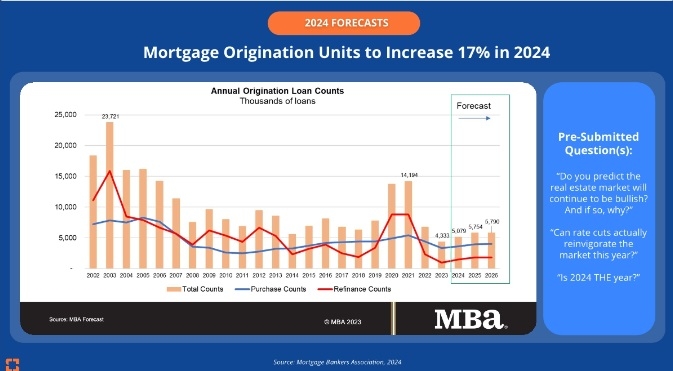

Just how difficult was it? In 2021 there were 14 million loan units, which dropped in half by 2022 and in 2023 there were only 4.3 million units, according to the MBA's data. Fratantoni predicted north of 5 million units in 2024.

"We expected another decline in volume, but the decline was bigger than we expected," Fratantoni said. "The purchase market was challenged all year long not just by rates, but by lack of inventory."

However, he's more hopeful about 2024 both due to rates and demographics.

When it comes to mortgage rates, "We think it will keep narrowing throughout the year," Fratantoni said adding he expects it to be closer to 6% by the end of the year." (Fannie Mae's Economic and Strategic Research Group is predicting mortgage rates will end the year below 6%.)

And the best news for loan originators is that demographics support a purchase market. Fratantoni said there are 50 million people between 30 and 40, about 1.5 million households per year, "who need to live somewhere, our industry is either going to finance them directly or their landlord." He said the demand is there, "it's really a question of supply."

Fratantoni said the lock-in effect has been real and it's not going away. There are just over 1 million homes for sale nationwide when it's typically 2.5 million to 3 million.

"Life is more important than mortgage rates," Fratantoni said.

Candice McNaught, senior vice president of national sales at Supreme Lending, agreed that demographics will be key in turning originations around.

"You've got housing affordability compressing this age demographic as well," McNaught said. She said this year the average was 36 and it's likely increasing to 38 years old.

However, other social trends at play will fade out as the country moves further away from a pandemic lifestyle.

“During COVID, so many people could work remotely, and they had the ability to just pick up and move and live wherever they wanted to, and they just weren’t ready to commit to a specific city or state,” McNaught said.

“I also think that some companies are bringing back and enforcing in-office work and that’s going to get people to plant their feet on the ground. It’s exciting because I do think that we have some great opportunities for first-time homebuyers this year, especially in the second half of this year.”

And Fratantoni expects refis to pick back up too, although not at a rapid pace, but homeowners with equity will be looking to consolidate some of their debt with cash-out refis.

He said to get to a true refi wave mortgage rates will have to hit 4%, but if everyone is writing purchase loans now at 6.5% then it will make it "easier for refis in the future." The latest MBA mortgage finance forecast predicts by the 4th quarter of 2024, refis will have increased from $75 billion in the fourth quarter of 2023 to $140 billion.