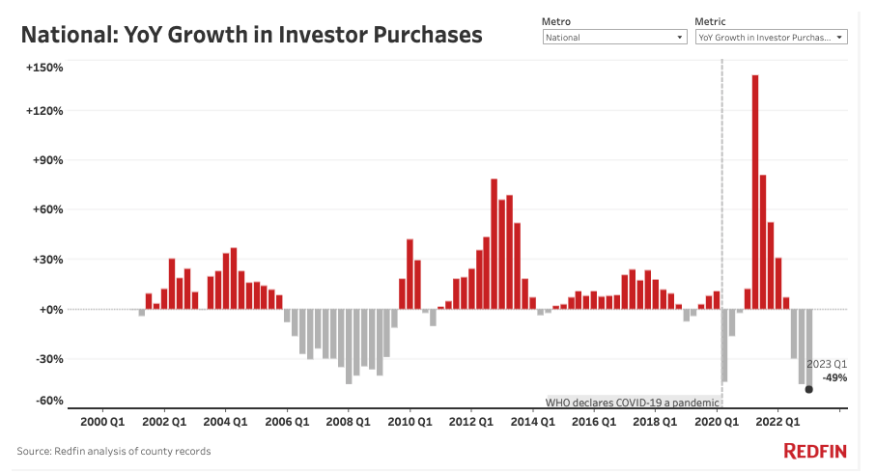

Investor Home Purchases In Q1 Fell A Record 49% YOY

Redfin report finds investors pumped the brakes due to high mortgage rates, low inventory.

- Investors still bought 18% of homes that sold, though that’s down from a peak of 20% a year earlier.

- Starter homes made up a record 2 in 5 investor purchases.

Real estate investors face the same issues homebuyers are dealing with in the housing market: high interest rates and low inventory.

According to a report from Redfin, that resulted in real estate investors buying 48.6% fewer homes in the first quarter of 2023 than they did a year earlier.

The online real estate brokerage said that was the largest annual decline on record, outpacing the 40.7% drop in overall home purchases in the 40 major metros tracked by Redfin.

Investor purchases also fell 15.9% on a quarter-over-quarter basis, comparable with the 14.7% quarterly drop in overall home purchases, Redfin said.

“While investors have pumped the brakes on home purchases, they’re still scooping up a bigger share of homes than they were before the pandemic, which can create challenges for individual buyers at a time when there are so few homes for sale,” said Redfin Senior Economist Sheharyar Bokhari. “Investors have gravitated toward more affordable properties due to still-high housing costs and rising mortgage rates, which has left first-time homebuyers with fewer starter homes to choose from.”

Investors bought up scores of homes during the pandemic because record-low mortgage rates and skyrocketing housing demand created opportunities for big returns on investment (ROI), Redfin said. Now investors are pulling back in response to rising interest rates, which are causing housing values to continue falling in much of the U.S. as homebuyer demand falters. While many investors buy homes with cash, they’re still affected by high interest rates because they often take out non-mortgage loans to cover renovations and other expenses.

“It’s been about eight months since one of my listings sold to an investor,” said Redfin Premier real estate agent Heather Kruayai in Jacksonville, Fla. “I rarely get offers from investors these days, and when I do, it’s a lowball offer on a house that’s been sitting for a while. Some smaller companies and mom-and-pop investors are still active in the market, but the big corporations aren’t buying anymore.”

Borrowing costs climbed even higher in May, meaning investors may pull back even further in the second quarter. Investor home purchases typically rise on a quarter-over-quarter basis in the spring, but may fall flat or decline when second-quarter data comes in, Redfin said.

Rent Growth An Issue

For investors who are landlords, slowing rent growth is also making it harder to reap profits, the company said. Investors who flip homes are also finding it more challenging to make money because they’re increasingly likely to resell homes at a loss due to declining home prices.

Roughly one of every seven homes (13.5%) sold by an investor in March sold for less than the investor bought it for, just shy of the seven-year high set in February, Redfin said. The share was even higher — 20.8% — for home flippers.

Investor home purchases in the first quarter of 2022 were near their record high, which is another reason the year-over-year decline in 2023 was so dramatic. Investors bought 41,181 homes in the metros tracked by Redfin in the first quarter of 2023, down from 80,128 a year earlier, which wasn’t far from the record high of 95,124 in the third quarter of 2021.

Overall, investors bought $27.5 billion worth of homes in the metros tracked by Redfin in the first quarter, down 46.3% from $51.2 billion one year earlier, and down 12.4% from $31.4 billion one quarter earlier. The typical home investors purchased cost $427,901, which means little changed from the prior quarter and a year earlier.

Market Share Remains High

While investors are purchasing fewer homes than they were before the pandemic, their market share remains relatively high — they bought 17.6% of homes purchased in the metros tracked by Redfin in the first quarter. That’s down from a peak of 20.4% a year earlier, but higher than any quarter on record prior to the pandemic, Redfin said.

Investor market share is likely above pre-pandemic levels in part because so many individual homebuyers have been priced out of the market, Bokhari said. For it to come down substantially, investors would need to pull back much more than regular buyers, and right now both groups are retreating rapidly from the market.

In Nassau County, N.Y., investor home purchases fell nearly 68% year over year in the first quarter, the largest decline among the 40 metros Redfin analyzed. Next were Atlanta and Charlotte, N.C., (both -66%), Phoenix (-64.2%), and Nashville, Tenn. (-60.4%). Rounding out the Top 10 were Las Vegas, Jacksonville, Philadelphia, Tampa, and Orlando, which all saw declines of more than 50%.

All but two of the metros above (Nassau County and Philadelphia) are in Sun Belt states, which soared in popularity among homebuyers during the pandemic. Investors swarmed in to capitalize on surging rents and home values, but are now pulling back as Sun Belt housing markets slow relatively quickly after getting overheated in recent years.

In Phoenix, 30.7% of homes sold by investors in March sold at a loss — the highest share of the 40 metros Redfin analyzed and more than double the national rate, a separate Redfin analysis found. Next came Las Vegas (28%), Jacksonville (20.9%), Sacramento, Calif., (20.2%) and Charlotte (17.4%).

Investor purchases may also be declining in Atlanta, Charlotte, Las Vegas, and Phoenix because those markets were popular among iBuyer investors. Many iBuying companies, including RedfinNow, ceased or slowed operations in recent years.

Baltimore saw the smallest decline in investor purchases, which fell 8.8% year over year in the first quarter. It was followed by Providence, R.I. (-9.6%), Seattle (-15.5%), Milwaukee (-21.6%) and Cleveland (-23.2%).

Investors lost market share in 17 of the 40 metros Redfin analyzed. Many of those are places where investor purchases dropped significantly. In Charlotte, investors bought 18.4% of homes purchased in the first quarter, down 14.1 percentage points from 32.5% a year earlier. That’s the largest percentage-point drop among the metros in this analysis.

Investors gained the most market share in Baltimore, where they bought 21.6% of homes purchased, up from 17% a year earlier (4.6 ppts).

Overall, investors had the highest market share in Miami, where they bought 30% of homes purchased in the first quarter. Rounding out the top five are Cleveland (24%), Anaheim, CA (22.6%) Detroit (22%) and Jacksonville (22%).

Investors had the lowest market share in Warren, MI (10.6%), Montgomery County, PA (10.6%), Washington, D.C. (10.6%), Minneapolis (11.1%) and Portland, OR (11.5%).

Buying Low-Priced Homes

Low-priced homes made up nearly half (48.7%) of investor purchases in the first quarter, the highest share in two years. Meanwhile, mid-priced homes represented about one-quarter (23.6%) of investor purchases, the lowest share in two years. High-priced homes made up 27.7%, little changed from the prior several quarters.

Investors bought 24.9% of all low-priced homes that were purchased in the metros tracked by Redfin in the first quarter, comparable with the 25.3% record high set a year earlier. Meanwhile, they bought 12.5% of mid-priced homes that were purchased, the lowest share in two years, and 15.3% of high-priced homes.

The investors who are still in the market have gravitated toward more affordable properties due to still-high home prices and elevated interest rates. A record 41.1% of investor purchases in the first quarter were starter homes— homes with 1,400 or fewer square feet—up from 37.2% a year earlier.