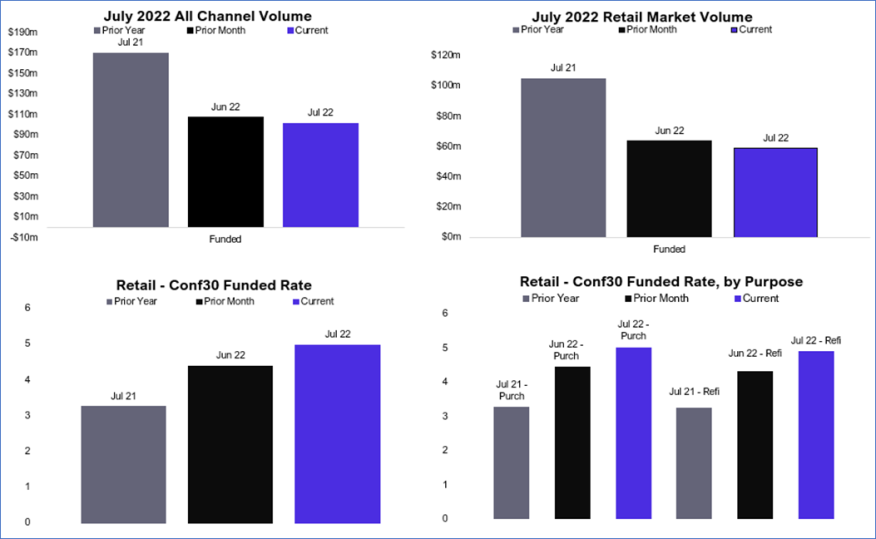

July 2022 Funded Mortgage Volume Decreased 53% From 2021

Curinos’ latest ‘Mortgage Hot Topics’ data, released on August 4, revealed that funded volume in the retail channel was down 57%.

- Purchase rates were found to be 28 basis points higher month-over-month and 237 basis points higher year-over-year.

- Month over month, conforming 30 year funded rates increased by about 28 basis points, and non conforming 30 year rates increased by 25 basis points.

In July, funded mortgage volume decreased 53% year-over-year and 15% month-over-month, according to Curinos’ latest ‘Mortgage Hot Topics’ data. Curinos also reported that in the retail channel, funded volume was down 57% year-over-year and 15% month-over-month.

Alexandra Jacobson, senior mortgage market analyst at Curinos, said this has changed the competitive landscape in the mortgage business. “There is less overall volume in the market however more or less the same number of market participants (mortgage banks/banks), meaning that they are all vying over a smaller pool and so there is more competition to win any given loan.”

Curinos, which gathers weekly originator data to produce aggregate reports for lenders, reported that the average funded conforming 30 year rate for ending the month of July is above 5.5%, resting at 5.58% during July. This was 27 basis points higher than June and 234 basis points higher than the same month last year

Purchase rates were found to be 28 basis points higher month-over-month and 237 basis points higher year-over-year, while refinance rates were 24 basis points higher month-over-month and 233 basis points higher year-over-year.

Continued Jacobson, “I think in terms of rates we’ve seen them dip overall, but it’d be interesting to see if rates eventually level off. Lenders are reducing margins internally to keep up with production, so it will be interesting to see how these rates continue to fluctuate during the rest of the year.”

Month over month, conforming 30-year-funded rates increased by about 28 basis points, and non-conforming 30-year rates increased by 25 basis points.

“Non-conforming in particular is recovering since hitting a low in 2020,” Jacobson said. “We’ve seen rates become stronger to match conforming rates.”

The spread between conforming adjusted rate mortgages (ARMs) and their 30-year counterparts increased incrementally month-over-month and is now just shy of half a point.

In July, funding in all channels saw a month over month increase of 25% in Syracuse, N.Y., and a 48% decrease in funded volume in Breckenridge, Colo. A 104% increase in funded volume was seen in Gardnerville Ranchos, Nev.