loanDepot Suspends Dividends After Heavy 1Q Losses

Originator reports a loss of $91 million on quarterly revenues of $503 million

- loanDepot board hasn't engaged in a strategic review.

- Expenses down, but further cuts planned in personnel, marketing costs.

- Quarterly revenues down more than 28%.

California-based loanDepot, a national mortgage funder, showed a first quarter loss of $91 million on quarterly revenues of $503 million, with the company’s chief financial officer, on the earnings call today, saying loanDepot will not be profitable this year but hasn’t engaged in a “strategic review” of the company.

“Our total expenses for the first quarter in 2022 decreased by $88 million, or 13% from the prior quarter, due primarily to lower variable expenses on lower loan origination volume and lower marketing expenses,” said loanDepot Chief Financial Officer Patrick Flanagan. “We are aggressively managing our cost structure to return to profitability by the end of the year. We expect to achieve this goal by further reducing marketing expenses and personnel expenses through the addition of head count reductions.

“Despite these further expense reductions, given our expectations for decreasing market volumes and the competitive pressures on margins, we do not expect to be profitable for the fiscal year ending 2022,” he added, saying that the board of directors has decided to “suspend payment of our regular dividend for the foreseeable future.”

During the question-and-answer period with analysts, Flanagan was asked if the board has engaged in a strategic review of the company.

“The short answer is no, at this point no,” Flanagan replied.

Quarterly revenues were down more than 28% from last year’s fourth quarter, when the company produced $705 million in quarterly revenue and quarterly profit of $14 million, the company’s documents showed.

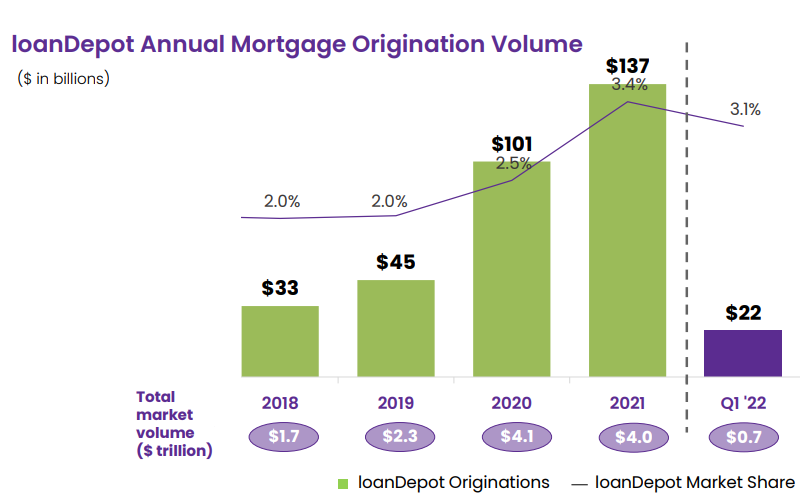

Loan origination volume during the quarter was $21.6 billion, down from $29 billion in the previous quarter, the company said.

“Our results reflected the sharp and rapid increase in market interest rates, which led to significantly lower profit margins during the latter half of the quarter,” said loanDepot founder and executive chairman Anthony Hsieh. “While we made progress toward our goal of reducing the expense base to align with earlier expectations, our volumes have continued to decline and expense reductions have not kept pace with the rapidly changing environment, intense competition, lower volume and decreasing profit margins are putting pressure on the entire industry, which I believe creates long-term opportunities for loanDepot to outperform less efficient, less diversified competitors.”

In April, loanDepot hired a new CEO. Hsieh, who has served as chairman and CEO since he founded the company in 2010, has been named executive chairman, while former CoreLogic CEO Frank Martell has been hired as the company’s president & CEO. Martell will focus on daily operations and lead the company’s diversified multi-channel mortgage origination model.

Martell said in then earnings announcement, "I recognize that there are short-term challenges facing the company due to market conditions that will have adverse impacts on our profitability in the near term. We have made and will continue to make progress on reducing our expenses to reflect our new expectations for industry volume. As part of that plan and as part of our balance sheet and capital management strategies, we are suspending our regular quarterly dividend for the foreseeable future."

The company expects loan origination volume in the second quarter to be between $13 and $18 billion.

The company is also expecting its new digital home equity loan product from its mello business unit in the third quarter.