Mortgage Application Payments Rose 2.5% In May

MBA’s Purchase Applications Payment Index hits record high.

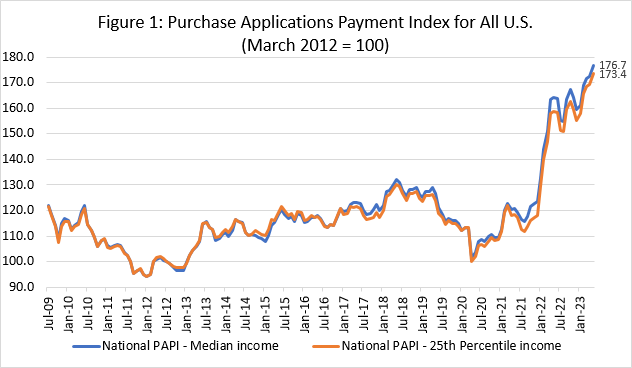

- The national PAPI also increased 2.5%, from 172.4 in April to 176.7 in May, a record high.

- The monthly mortgage payment rose in May to $2,165, up 2.5% from $2,112 in April.

The national median payment applied for by home purchase applicants increased 2.5% in May, as the Mortgage Banker Association’s (MBA) monthly mortgage payment index hit an all-time high.

According to the MBA’s Purchase Applications Payment Index (PAPI), which uses data from its Weekly Application Survey to measure how new monthly mortgage payments vary across time relative to income, the monthly mortgage payment rose in May to $2,165, up 2.5% from $2,112 in April.

The national PAPI also increased 2.5%, from 172.4 in April to 176.7 in May, a record high. Compared to May 2022 (163.2), the index is up 7.6% percent, the MBA said.

An increase in the PAPI — a sign of declining borrower affordability conditions — means that the mortgage payment-to-income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. A decrease in the PAPI — a sign of improving borrower affordability conditions — occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

“Homebuyer affordability eroded further in May as prospective buyers continue to grapple with high interest rates and low housing inventory,” said Edward Seiler, MBA's associate vice president, Housing Economics, and executive director, Research Institute for Housing America. “While supply remains low, we do expect that inventory will pick up in the near term, which will provide more opportunities for borrowers to buy a home.”

For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment increased to $1,462 in May from $1,430 in April, the MBA said.

The Builders’ Purchase Application Payment Index (BPAPI) showed that the median mortgage payment for purchase mortgages from MBA’s Builder Application Survey increased 2.9%, from $2,445 in April to $2,515 in May.

Additional Key Findings:

- The national median mortgage payment was $2,165 in May, up from $2,112 in April and from $2,093 in March. It is up $268, or 14.1%, from a year ago.

- The national median mortgage payment for FHA loan applicants was $1,802 in May, up about 3% from $1,750 in April, and up 26% from $1,430 in May 2022.

- The national median mortgage payment for conventional loan applicants was $2,202, up 1.5% from $2,170 in April, and up 12.4% from $1,960 in May 2022.

- The top five states with the highest PAPI were: Nevada (263.4), Idaho (258.5), Arizona (234.4), California (227.7), and Florida (225.3).

- The top five states with the lowest PAPI were: Connecticut (122.2), West Virginia (122.6), Alaska (122.6), Louisiana (133.7), and Wyoming (136.8).

- Homebuyer affordability decreased for Black households, with the national PAPI increasing from 176.7 in April to 181.1 in May.

- Homebuyer affordability decreased for Hispanic households, with the national PAPI increasing from 161.1 in April to 165.1 in May.

- Homebuyer affordability decreased for White households, with the national PAPI increasing from 173.0 in April to 177.3 in May.