Mortgage Applications For New Homes Fell Sharply In April, But Remain Up YOY

Applications in April fell 11% from March, but were up from a year earlier for the third straight month.

- The 11% drop followed a 0.6% month-over-month increase in March and a 1.2% increase in February.

- MBA estimates new single-family home sales at a seasonally adjusted annual rate of 649,000 units in April.

Applications for mortgages to buy a newly constructed homes fell sharply in April after two straight monthly declines, the Mortgage Bankers Association reported Friday.

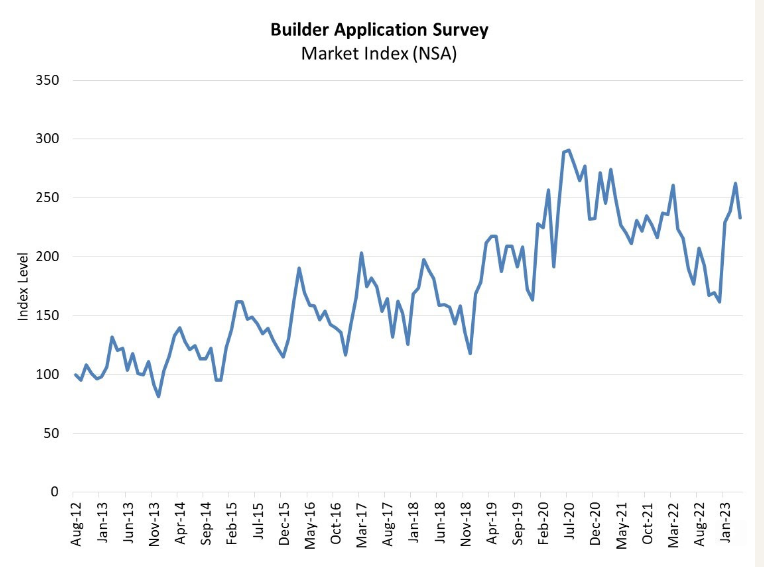

According to the MBA’s Builder Application Survey (BAS) data for April 2023, mortgage applications for new home purchases decreased 11% from March. The change does not include any adjustment for typical seasonal patterns, MBA said.

The 11% drop followed a 0.6% month-over-month increase in March and a 1.2% increase in February.

The volume of applications, however, increased 4.1% in April from a year earlier, the third consecutive month with a year-over-year increase.

Joel Kan, MBA’s vice president and deputy chief economist said the string of year-over-year increases is a sign of improving demand for newly built homes, “at a time when the broader housing market is leaning more on new construction to boost for-sale inventory levels.”

Kan noted that mortgage rates have settled in the 6.5% range and remain more than a percentage point higher than at this point last year. “The higher mortgage rate environment continues to factor into home-buying and selling decisions,” he said.

“Since the brief pick-up in new home sales in January, when mortgage rates dipped, the pace of new home sales has declined for the three consecutive months,” Kan said. “With the recently released Census data showing single-family permitting activity on the upswing and housing starts also rising, we expect that to translate to growth in new home sales activity in the second half of the year.”

MBA estimates new single-family home sales — which consistently have been a leading indicator of the U.S. Census Bureau’s New Residential Sales report — were running at a seasonally adjusted annual rate of 649,000 units in April 2023, based on data from the BAS.

The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors, MBA said.

The seasonally adjusted estimate for April is a decrease of 2.6% from the March pace of 666,000 units. Unadjusted, MBA estimates there were 58,000 new home sales in April 2023, a decrease of 10.8% from 65,000 new home sales in March.

By product type, conventional loans were 66.2% of loan applications, FHA loans were 23.4%, VA loans were 10%, and RHS/USDA loans were 0.4%. The average loan size of new homes decreased from $407,015 in March to $401,756 in April.

MBA said its Builder Application Survey tracks application volume from mortgage subsidiaries of home builders across the country. Using that data, as well as data from other sources, MBA provides an early estimate of new home sales volumes at the national, state, and metro level. The data also provides information about the types of loans used by new home buyers.

Official new home sales estimates are provided by the Census Bureau on a monthly basis. In that data, new home sales are recorded at contract signing, which is typically coincident with the mortgage application, MBA said.