Mortgage Applications For New Homes Rose 16.6% In May

It was the 4th straight month with a year-over-year increase.

- Applications also increased 8% from April.

- New home sales are growing from a year earlier while sales of existing homes are shrinking.

Mortgage applications for new home purchases rose 16.6% in May from a year earlier, marking four straight months of year-over-year increases, the Mortgage Bankers Association (MBA) said Tuesday.

The MBA’s Builder Application Survey (BAS) data for May 2023 also found that applications increased 8% from April, unadjusted for typical seasonal patterns.

“Purchase activity for newly built homes was strong in May, with builders continuing to bring homes to the market and buyers keen to act on available units,” said Joel Kan, MBA’s vice president and deputy chief economist. “Applications for purchase loans were up on a monthly basis and increased annually for the fourth consecutive month. Our estimate of new home sales also jumped in May, up 16% to the fastest pace of new home sales in 15 months.”

Kan added that the new home sales segment “continues to gather momentum, growing at a pace of 5% compared to a year ago, while existing-home sales in recent months continue to experience annual declines of more than 20% on a non-seasonally adjusted basis. These results were also broadly in line with the census data showing an uptick in residential housing starts and permitting in recent months.”

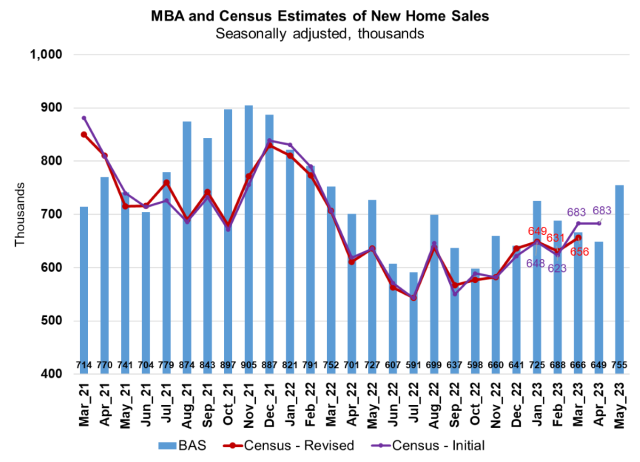

MBA estimated new single-family home sales— a leading indicator of the U.S. Census Bureau’s New Residential Sales report — were running at a seasonally adjusted annual rate of 755,000 units in May, based on data from the BAS. The new home sales estimate is calculated using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors, the MBA said.

The seasonally adjusted estimate for May is an increase of 16.3% from the April pace of 649,000 units. On an unadjusted basis, MBA estimated that there were 64,000 new home sales in May, up 10.3% from 58,000 new home sales in April.

By product type, conventional loans comprised 67% of loan applications, FHA loans comprised 22.8%, USDA loans comprised 0.3%, and VA loans comprised 10%, MBA said.

The average loan size for new homes increased 0.45% from $401,756 in April to $403,581 in May.

MBA’s Builder Application Survey tracks application volume from mortgage subsidiaries of home builders across the country. Utilizing this data, as well as data from other sources, MBA is able to provide an early estimate of new home sales volumes at the national, state, and metro level.

The data also provides information about the types of loans used by new home buyers. Official new home sales estimates are conducted by the Census Bureau on a monthly basis. In that data, new home sales are recorded at contract signing, which is typically coincident with the mortgage application.