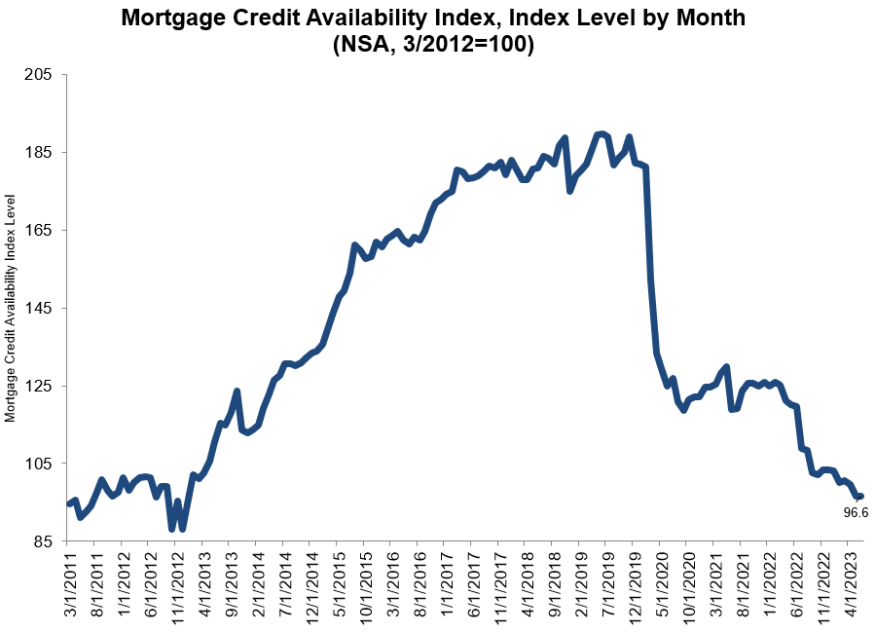

Mortgage Credit Availability Rises (Barely) In June

Credit remains near its tightest level in the past decade.

- The Mortgage Credit Availability Index (MCAI) rose by 0.1 percentage point to 96.6 in June.

- The Conventional MCAI was unchanged.

- The Jumbo MCAI decreased by 0.2% percent, while the Conforming MCAI rose by 0.2%.

Mortgage credit availability ticked up in June, but remained near a decade low, the Mortgage Bankers Association (MBA) said Tuesday.

The MBA released its monthly Mortgage Credit Availability Index (MCAI), a report that analyzes data from ICE Mortgage Technology.

The MCAI rose by 0.1 percentage point to 96.6 in June. An increase in the MCAI indicates loosening credit, while a decline indicates that lending standards are tightening. The index was benchmarked to 100 in March 2012.

The Conventional MCAI was unchanged, while the Government MCAI was essentially unchanged, the MBA said.

Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by 0.2% percent, while the Conforming MCAI rose by 0.2%.

“Mortgage credit availability was essentially unchanged in June, remaining close to the lowest level since early 2013, as the industry continues to operate at reduced capacity,” said Joel Kan, MBA’s vice president and deputy chief economist.

“Lenders are streamlining their operations by offering fewer loan programs, with some exiting certain channels,” Kan said. “Data from our Weekly Applications Survey indicated that June mortgage applications were more than 30% lower than a year ago and at the slowest pace since December 2022.”

Kan added that the Jumbo Index declined for the second straight month, “as liquidity conditions have been tightening for jumbo lending.”

The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). MBA combines the metrics and underwriting criteria for over 95 lenders/investors, using data made available via ICE Mortgage Technology and a proprietary formula derived by MBA to calculate the MCAI. The index is a summary measure that indicates the availability of mortgage credit at a point in time. Base period and values for the total index is March 31, 2012=100; Conventional March 31, 2012=73.5; and Government March 31, 2012=183.5.