Mortgage Economic Review For August 2022

Summary & review of key economic data that affects the mortgage and real estate industries.

By Mark Paoletti

Mortgage Elements Inc.

The Mortgage Economic Review is a monthly summary of key economic indicators, data, and events pertinent to mortgage and real estate professionals.

At A Glance: Key Economic Data and Events during July 2022

- Interest rates initially rose, then fell in July after the Federal Reserve increased the federal funds rate by 0.75%. The 10-Year Treasury yield fell to 2.67% (July 29) from 2.98% (June 30).

- Housing: Existing home sales fell 5.4%, New home sales fell 8.1%, and pending home sales fell 8.6%. Home prices continued to climb at an 18%-20% annual pace.

- Labor: The economy created 372,000 new jobs in June. The unemployment rate held steady at 3.6% for the last four months, and wages increased 5.1% year over year.

- Inflation: Consumer Price Index (CPI) up 1.3% (+9.1% YoY), Producer Price Index (PPI) up 1.1%% (+11.3% YoY) in June.

- The Economy: U.S. Gross Domestic Product (GDP) contracted at a 0.9% annualized rate in the second quarter of 2022, up 1.6% YoY.

- Consumers: Retail sales rose 1% in June, while consumer confidence declined.

- Stock Markets: All rose in July: Dow Jones,+5.6%; S&P 500, +8%; Nasdaq, +11.4%.

- Oil & Energy: Oil prices fell during July, closing at $104/barrel (July 29) from $110 (June 30). Natural gas prices soared to $8.23/MMBtu (July 29) from $5.46 (June 30).

Interest Rates and Fed Watch

As expected, the Federal Reserve raised the federal funds rate by another 0.75%. The Fed has a dual mandate: price stability and full employment. We have full employment, so it is focused on price stability. That means getting inflation under control, even if it sends the economy into a recession. The Fed believes it can engineer a “soft landing,” but it’s a 50/50 chance. One way or another, soft or hard landing, the Fed is determined to bring down inflation. That means it will continue to raise interest rates until inflation subsides. The next Federal Open Market Committee meeting is set for Sept. 21 and 22.

- 10-Year Treasury Security Yield fell to 2.67% (July 29) from 2.98% (June 30).

- 30-Year Treasury Bond Yield fell to 3% (July 29) from 3.14% (June 30).

- 30-Year Fixed Mortgage fell to 5.3% (July 28) from 5.7% (June 30).

- 15-Year Fixed Mortgage fell to 4.58% (July 28) from 4.83% (June 30).

- 5/1 ARM Mortgage fell to 4.29% (July 28) from 4.5% (June 30).

- Federal Funds Target Range: 2.25% to 2.5%.

Housing Market Data Released in July 2022

Housing data released in July was disappointing. Existing, new, and pending home sales all declined. The combination of high prices and high interest rates crushed affordability and the consumer’s appetite to buy a home. On a positive note, new home inventory rose 10,000 units to 457,000, plus there are 834,000 single-family units under construction. More new homes are on the way, which is a good thing. It's the same scenario for the existing-home market, as inventory rose 10%. As inventory accumulated, the average price of a new home fell 11% from May to June. The Federal Housing Finance Agency (FHFA) and Case-Shiller Home Price indexes still show price appreciation of about 20% YoY. Remember, these are lagging indicators with a three-month average; they should start to reflect slower price appreciation in the next few months.

- Existing-Home Sales (closed deals in June) fell 5.4% to an annual rate of 5.12 million homes, down 14.2% in the last 12 months. The median price for all types of homes is $416,000, up 13.4% from a year ago. The median single-family home price is $423,300, up 13.3% YoY. The median condo price is $354,900, up 11.5% YoY. Homes were on the market for an average of 14 days, and 88% were on the market for less than a month. Currently, 1.26 million homes are for sale, up 2.4% YoY from 1.23 million units a year ago; 25% were all cash sales.

- New Home Sales (signed contracts in June) fell 8.1% to a seasonally adjusted annual rate of 590,000 homes, down 17.4% YoY. The median new home price fell 9.4% (+7.4% YoY) to $402,400 from $444,500 the prior month. The average price fell 11.1% (+5.8% YoY) to $456,800 from $514,000 the prior month. There are 457,000 new homes for sale, a 9.3-month supply..

- Pending Home Sales Index (signed contracts in June) fell 8.6% to 91.0 from 99.9 the previous month, down 20% YoY.

- Building Permits (issued in June) fell 0.6% to a seasonally adjusted annual rate of 1.69 million units, up 1.4% YoY. Single-family permits fell 8% to an annual pace of 967,000 homes, down 11.4% YoY.

- Housing Starts (excavation began in June) fell 2% to an annual adjusted rate of 1.56 million, down 6.3% YoY. Single-family starts fell 8.1% to 982,000 units, down 15.7% YoY.

- Housing Completions (completed in June) fell 4.6% to an annual adjusted rate of 1.365 million units, up 4.6% YoY. Single-family completions fell 4.1% to an annual adjusted rate of 966,000 homes, up 8.5% YoY.

- S&P/Case-Shiller 20-City Home Price Index rose 1.3% in May, up 20.5% YoY.

- FHFA Home Price Index rose 1.4% in May, now up 18.3% YoY.

Labor Market Economic Data Released in July 2022

The economy created 372,000 new jobs in June, and the unemployment rate has held steady at 3.6% for the last four months. The labor data doesn’t show any slowdown in the jobs market, but these are lagging indicators. A few recent surveys show that many large employers (especially in the tech sector) lowered or paused their planned future new hires. If that is the case, a slowdown in job growth hasn’t shown up in the data yet. Weekly jobless claims inched up in July. This is not significant yet, but economists are watching to see if a trend starts to appear. It’s hard to declare we are in a recession when the labor market is tight, with unemployment at 3.6% and there are over 11 million job openings.

- The economy created 372,000 new jobs during June.

- The unemployment rate was unchanged at 3.6% in June.

- The labor force participation rate fell to 62.2% in June from 62.3% in May.

- The average hourly wage rose 0.3% in June, up 5.1% YoY.

- Job openings fell to 11.25 million in May from 11.68 million in April.

Inflation Economic Data Released in July 2022

Unfortunately, the inflation data is getting worse with each passing month. The CPI continues to set records, rising 1.3% in June and up 9.1% YoY. This recent data eclipsed economists’ expectations of 8.8% and set a 40-year record high. Most economic experts, including the Fed, did not foresee inflation at these levels. The Fed still contends current inflationary woes are due to supply-chain disruptions and not a result of past monetary policy. Regardless of the cause, The Fed is determined to slay high inflation, and raising interest rates is its weapon.

- CPI rose 1.3%, up 9.1% YoY | Core CPI rose 0.7%, up 5.9% YoY

- PPI rose 1.1%, up 11.3% YoY | Core PPI rose 0.4%, up 8.2% YoY

- PCE rose 1%, up 6.8% YoY | Core PCE rose 0.6%, up 4.8% YoY

GDP Economic Data Released in July 2022

The first estimate for second-quarter GDP showed the U.S. economy contracted by a 0.9% annualized rate, up 1.6% YoY. The classic definition of a recession is two-consecutive quarters of negative growth. By that definition, we are in a recession, but it’s not that simple. The final call comes from the National Bureau of Economic Research, and it usually calls it late. It’s not clear if we are in a recession or not. If we are in a recession, it’s the weirdest and most anticipated recession in recent history. However, it is clear the Fed’s tight monetary policy is rapidly cooling the economy, which should be reflected in the upcoming economic data this fall.

Consumer Economic Data Released in July 2022

Consumers are nervous, and that is reflected in the consumer confidence and sentiment data. Both indexes are at or near record lows. Inflation makes people feel poorer and helpless. Helpless because higher prices for life’s necessities — food, fuel, & shelter — are out of their control. Poorer because their wages are not keeping up with price increases. They are reminded of their helplessness with every visit to the grocery store or gas station. When consumers feel poor, they stop spending money.

- Retail sales rose 1% during June, now up 8.4% in the last 12 months.

- Consumer Confidence Index fell 2.7% to 95.7 from 98.4 prior month, down 23.5% YoY.

- Consumer Sentiment Index (University of Michigan) rose to 51.5 from 50.0 the previous month.

Energy, International, and Things You May Have Missed

- West Texas Intermediate Crude fell to $99/barrel (July 29) from $106 (June 30).

- North Sea Brent Crude fell to $104/barrel (July 29) from $110 (June 30).

- Natural gas soared to $8.23/MMBtu (July 29) from $5.46 (June 30).

- Saber Rattling with China: Chinese President Xi warned President Biden “not to play with fire,” voicing his displeasure over a proposed visit to Taiwan by U.S. House Speaker Nancy Pelosi.

- Food Riots: Sri Lankan President Gotabaya Rajapaksa stepped down after protesters, angry about food and fuel prices, stormed the Presidential Palace.

- The Dollar hits parity (same value) with the Euro for the first time in 20 years.

- Turkey’s annual inflation rate surged to 79%, the highest level in 24 years.

- A heat wave swept across Europe, setting record high temps; Portugal set a high of 116° F.

- Former Japanese Prime Minister Shinzo Abe was assassinated with a homemade gun.

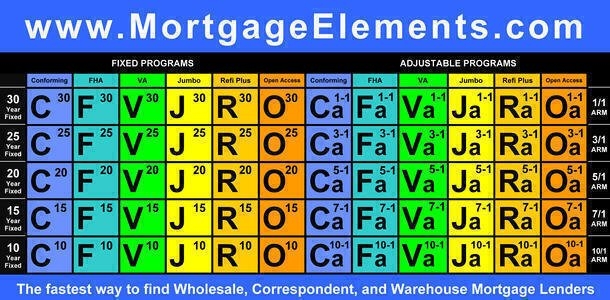

The Mortgage Economic Review is produced by Mortgage Elements Inc. and MortgageElements.com, and is a concise summary of key economic data that influences the mortgage and real estate industries. The information is gathered from sources believed to be credible; some are opinion-based and editorial in nature. Mortgage Elements Inc. does not guarantee or warrant its accuracy or completeness.